If your portfolio needs stability with equity growth, Large Cap Mutual Funds are the anchor. They invest in the market’s biggest, most established companies, businesses with durable cash flows, strong managements, and deeper liquidity. Think “foundation first,” then add satellite growth.

Table of Contents

ToggleLarge Cap Mutual Funds – A Quick Glance

- Definition: Large Cap Mutual Funds invest predominantly in the biggest listed companies, offering stability, liquidity, and steady compounding.

- Why They Matter: Lower volatility vs. mid/small caps; better downside protection in drawdowns.

- Who Should Invest: All investors building a core equity allocation—beginners to veterans.

- Ideal Use: Core portfolio anchor complemented by other types of mutual funds (flexi-cap, mid/small, hybrid).

- SIP or Lumpsum: Works well for both; SIP is effortless, lumpsum suits rebalancing or cash infusions.

- Taxation (Equity Funds in India): STCG @ 15% (<12 months); LTCG @ 10% on gains above ₹1 lakh (>12 months).

- Advisor Tip: Use Mutual fund distributors in Delhi NCR for fund selection, overlap checks, and rebalancing.

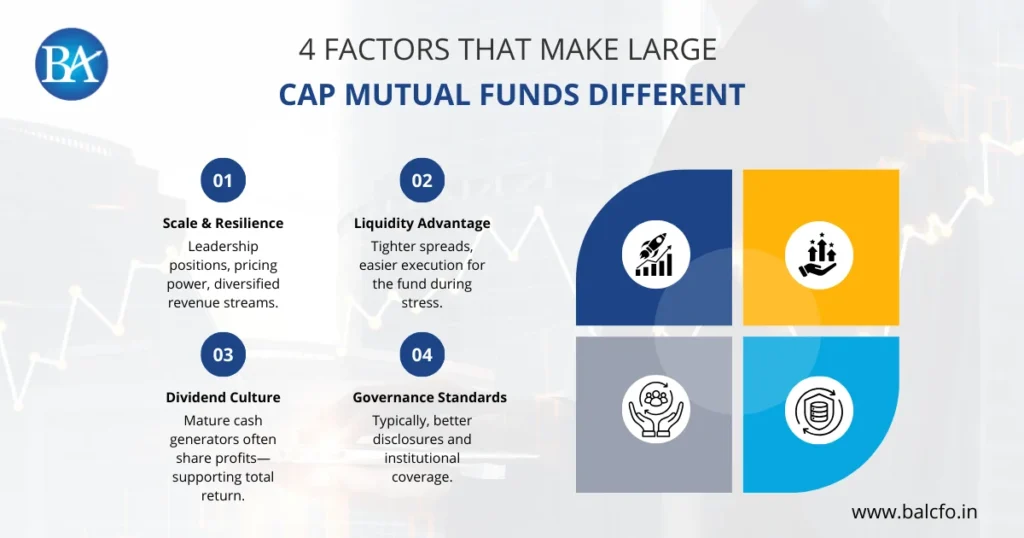

4 Factors that Make Large Cap Mutual Funds Different

- Scale & Resilience: Leadership positions, pricing power, diversified revenue streams.

- Liquidity Advantage: Tighter spreads, easier execution for the fund during stress.

- Dividend Culture: Mature cash generators often share profits—supporting total return.

- Governance Standards: Typically, better disclosures and institutional coverage.

Why Large Cap Mutual Funds are the Core

- Drawdown Cushion: They usually fall less in big corrections.

- Compounding Engine: Consistent earnings plus dividends.

- Lower Tracking Error: Portfolios often align with benchmarks, reducing surprises.

- Simple to Stick With: Fewer sleepless nights means better investor behaviour.

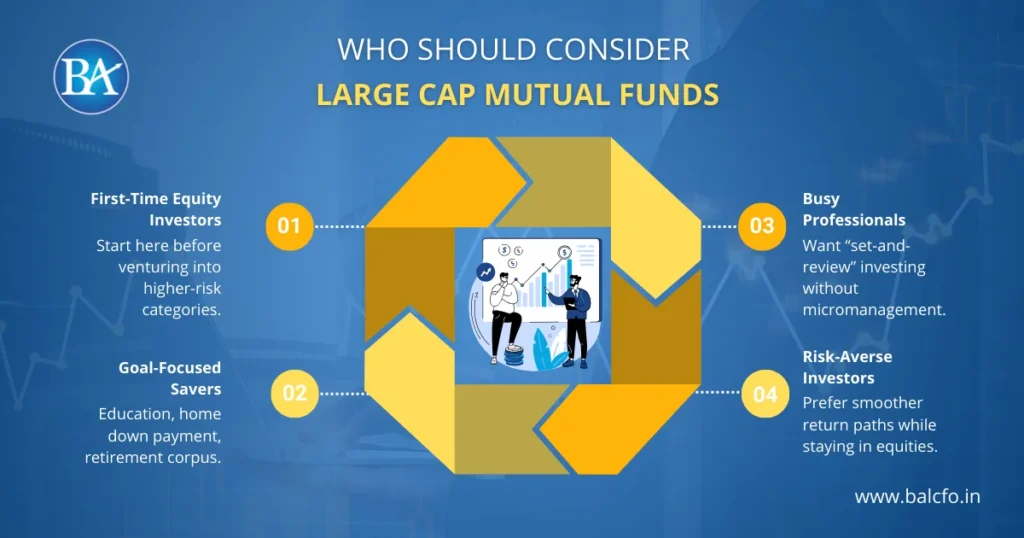

Who Should Consider Large Cap Mutual Funds

- First-Time Equity Investors: Start here before venturing into higher-risk categories.

- Goal-Focused Savers: Education, home down payment, retirement corpus.

- Busy Professionals: Want “set-and-review” investing without micromanagement.

- Risk-Averse Investors: Prefer smoother return paths while staying in equities.

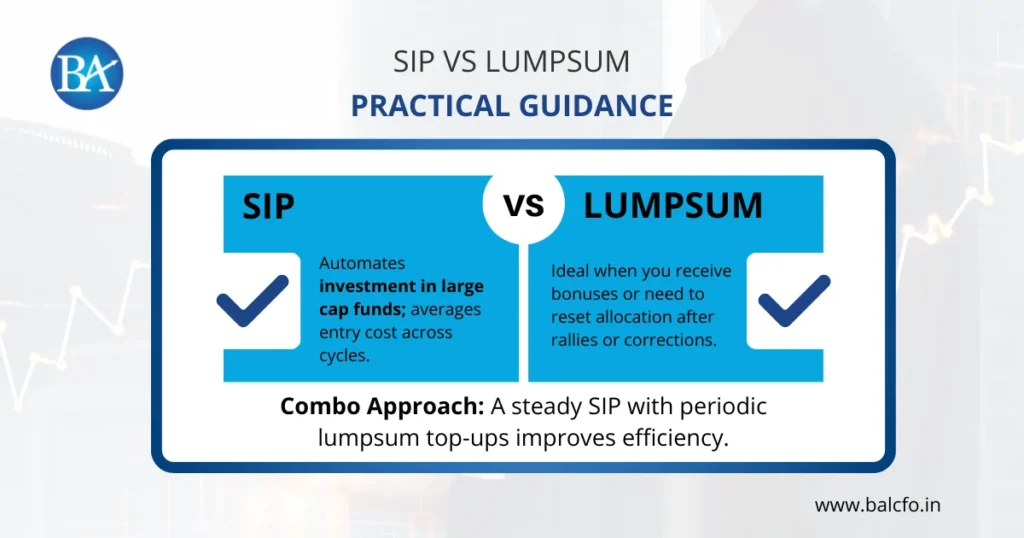

SIP Vs Lumpsum: Practical Guidance

- SIP For Discipline: Automates investment in large cap funds; averages entry cost across cycles.

- Lumpsum For Rebalancing: Ideal when you receive bonuses or need to reset allocation after rallies or corrections.

- Combo Approach: A steady SIP with periodic lumpsum top-ups improves efficiency.

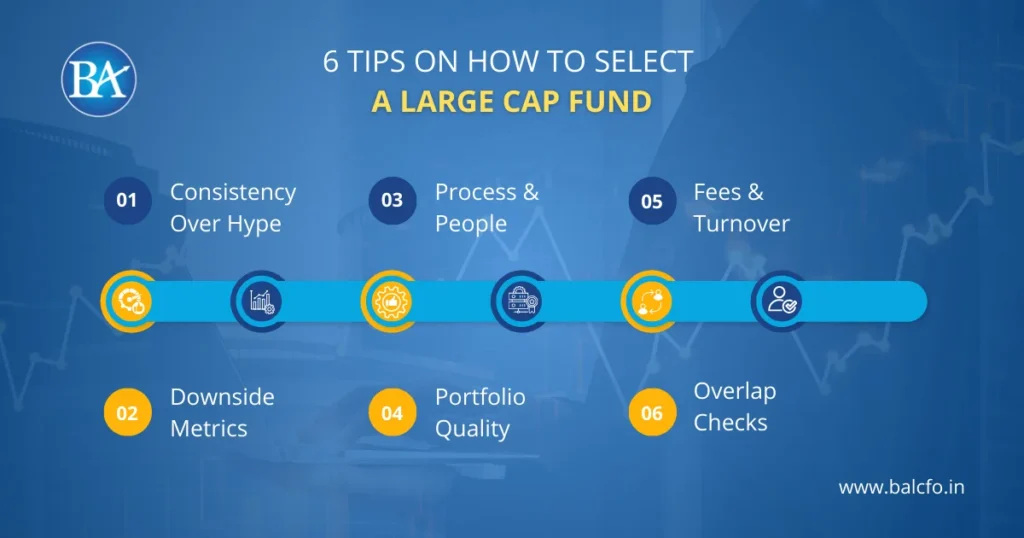

6 Tips on How to Select a Large Cap Fund

- Consistency Over Hype: Look at 5–7 year records across different markets.

- Downside Metrics: Max drawdown, recovery time, falling market capture ratios.

- Process & People: Manager tenure, team depth, buy/sell discipline.

- Portfolio Quality: Return on capital, free cash flow, balance-sheet strength.

- Fees & Turnover: Lower costs can lift long-term outcomes; avoid excessive churn.

- Overlap Checks: If you already own a flexi-cap, ensure you’re not doubling the same top holdings.

Role in Asset Allocation

A simple starting point: 40–60% of your equity bucket in Large Cap Mutual Funds, the rest across flexi/mid/small or international. Rebalance annually to keep risk in line with goals.

Taxes, Costs, Documentation

- Tax (Equity Funds): STCG 15% (<12 months); LTCG 10% beyond ₹1 lakh gains (>12 months).

- Expense Ratios: Typically lower than small/mid-cap categories.

- KYC & Mandates: Complete KYC and set SIP mandates or scheduled transfers.

5 Common Mistakes to Avoid When Selecting a Large Cap Fund

- Chasing last year’s top quartile without checking consistency

- Owning too many funds with overlapping top holdings

- Stopping SIPs during corrections (missing cheaper units)

- Ignoring rebalancing for years

- Not consulting Mutual fund distributors in Gurgaon for suitability reviews

Simple Portfolio Use Case

A working professional can anchor 50% of equities in Large Cap Mutual Funds, 25% in flexi-cap, 15% in mid-cap, and 10% in small-cap. Review twice a year and rebalance annually—this keeps growth potential while controlling risk.

Disclaimer: Investments are subject to market risks. This is educational, not investment advice. Consult an advisor before investing.

Speak With the BellWether Team

Build a steadier core with BellWether. Our advisory team, trusted Mutual fund distributors in Delhi NCR and experienced SIP distributors in Gurgaon, can help you select, size, and automate large-cap mutual funds that fit your plan. Book a quick discovery call and start your SIP today.

FAQs on Large Cap Mutual Funds

1) Are Large Cap Mutual Funds Good For Beginners?

Yes. They provide stability, liquidity, and simpler behaviour to stick with, ideal for the first core allocation.

2) How Much Should I Allocate To Large Caps?

For many investors, 40–60% of the equity bucket is reasonable. Adjust with your advisor and risk profile.

3) Do Large Caps Underperform Over Long Periods?

Not necessarily. They tend to deliver steadier compounding, though small/mid caps can outperform in risk-on phases. The right mix depends on your goals.

4) Is SIP Better Than Lumpsum for Large Caps?

SIP works for discipline and averaging; a lump sum suits rebalancing or deploying cash in one go. Many combine both for investment in large cap funds.

5) How Do I Avoid Holding Duplicates?

Review top holdings across funds. Too many products from the same category can create overlap without new benefits.

6) What Metrics Should I Track Post-Investment?

Rolling returns, downside capture, expense ratio changes, and whether the fund is sticking to its stated process.

7) Can Large Caps Help During Market Stress?

They generally fall less than small/mid caps and recover faster, helping you stay invested through volatility in type of mutual funds decisions.