SIP in mutual funds is one of the most popular and reliable ways to build long-term wealth in India. In 2025, more than 8.6 crore SIP accounts are active, with monthly contributions crossing ₹27,000 crore according to AMFI reports.

If you are new to investing and wondering how to get started, understanding SIP in mutual funds is the first step towards disciplined, goal-based investing. This guide covers what SIP is, the benefits of SIP, the different types of SIP available, and how mutual fund distributors in Delhi NCR can help you make smarter investment choices.

Table of Contents

ToggleWhat is SIP in Mutual Funds

SIP in mutual funds, or Systematic Investment Plan, allows you to invest a fixed sum of money at regular intervals, usually monthly, into a chosen mutual fund scheme. Instead of investing a large amount at once, SIP breaks down the investment into smaller portions, making it more manageable.

It works on the principle of rupee cost averaging, meaning you buy more units when prices are low and fewer when prices are high, resulting in a balanced average cost over time.

The biggest advantage of SIP is that you can start with as little as ₹500 and stay invested without worrying about market timing. Over time, compounding helps your investments grow significantly.

4 Benefits of SIP in Mutual Funds

The benefits of SIP go beyond just convenience. SIP creates a habit of investing regularly, which is crucial for building wealth. It protects you from making emotional investment decisions during market fluctuations and ensures that you stay on track with your goals. Some key benefits include:

- Disciplined approach: Automates saving and investing, ensuring consistency.

- Compounding advantage: Small investments grow exponentially over time.

- Flexibility: You can increase, decrease, or pause SIP contributions anytime.

- Low entry barrier: You don’t need a large sum to start investing.

This makes it a great option for both beginners and seasoned investors, offering a stress-free way to create long-term financial security.

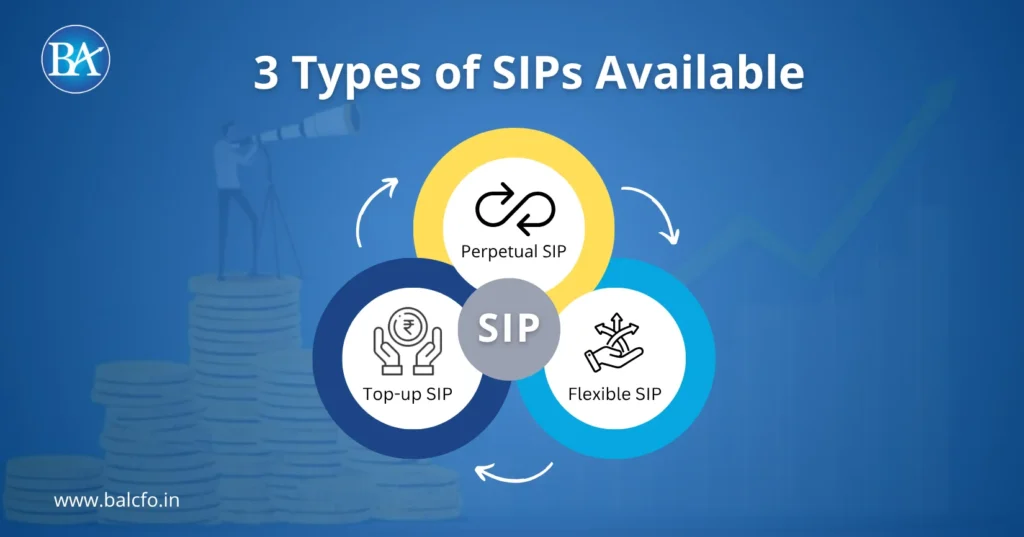

3 Types of SIP Available

Different types of SIP cater to varied investor needs. Choosing the right option helps you align your investments with your goals and income growth.

1. Top-up SIP: Lets you increase the amount at set intervals, ideal when your income rises.

2. Perpetual SIP: Has no end date and continues until you stop it manually.

3. Flexible SIP: Allows changing the contribution amount based on your cash flow.

These types of SIP make it easier to tailor your plan to your financial situation, ensuring that SIP in mutual funds works effectively for you at every life stage.

2025 Trends in SIP in Mutual Funds

The popularity of SIP in mutual funds has grown significantly in 2025. According to AMFI, SIP assets under management have surpassed ₹15 lakh crore, accounting for more than 20% of total mutual fund industry assets.

SIP distributors have reported a sharp rise in new SIP registrations from young professionals and first-time investors. Historical data shows that a monthly SIP of ₹10,000 in equity funds over 20 years could grow to over ₹1.2 crore at an average return of 11–12% CAGR. These figures highlight why SIP remains a trusted investment route.

How to Start SIP in Mutual Funds

To start SIP in mutual funds, first set your financial goals and understand your risk appetite. Then, choose a mutual fund scheme that matches your objectives, whether equity for long-term growth, hybrid for balance, or debt for safety. Decide your monthly SIP amount and frequency based on your budget.

Complete KYC formalities and set up an auto-debit mandate through a bank or platform. Consulting mutual fund distributors in Gurgaon can help you select the right fund and optimize your investment plan. Monitoring performance periodically and increasing contributions over time ensures you make the most of SIP investing.

Why BellWether Recommends SIP in Mutual Funds

At BellWether, we believe SIP is a powerful tool for long-term wealth creation. With expert guidance and structured planning, SIPs can help you achieve financial freedom without market timing stress.

Our experience shows that SIP investments outperform lump-sum investments during volatile periods, offering better average costs and steady returns over time.

Start Your SIP Journey with BellWether

Ready to grow your wealth systematically? At BellWether, we help you:

- Define your financial goals and choose the right mutual fund schemes.

- Identify the most suitable investment options based on your income and objectives.

- Connect with top mutual fund distributors in Delhi NCR for seamless onboarding.

- Set up and automate SIP contributions for consistent investing.

- Track and adjust your SIP to align with changing goals.

FAQs on SIP in Mutual Funds

1. What is SIP in mutual funds, and why is it popular?

SIP in mutual funds is a structured way of investing fixed amounts regularly into mutual funds. It is popular because it promotes disciplined investing, reduces market timing risk, and grows wealth steadily using compounding.

2. How do the benefits of SIP compare to lump-sum investments?

SIP spreads investments over time, reducing volatility risk. Lump-sum investments depend heavily on timing. SIP builds consistency, offers cost averaging, and makes investing easier for beginners.

3. What types of SIP are available for investors?

Types of SIP include Top-up SIP, Flexible SIP, and Perpetual SIP. Each type provides flexibility in contribution amounts or duration, making it easier to match your investment style and financial goals.

4. Can mutual fund distributors in Delhi NCR help with SIP setup?

Yes, professional distributors guide you in fund selection, completing KYC, automating contributions, and monitoring performance, ensuring your SIP works effectively.

5. How long should SIP in mutual funds be continued for good returns?

SIP should ideally continue for at least 5–10 years to leverage compounding fully and reduce short-term volatility impact. Longer durations help create significant wealth for future goals.