When investors start exploring mutual funds, one common question often comes up: How can I invest in equities across different company sizes without constantly rebalancing my portfolio?

This is where a multi cap fund becomes valuable. Multi cap funds offer a well-diversified equity allocation by investing across large-cap, mid-cap, and small-cap companies. They are designed for investors who want both stability and growth potential within a single scheme.

In this article, we will explain the meaning of multi cap fund, its features, and the types of multi cap funds that investors should know before making decisions.

Table of Contents

ToggleMeaning of Multi Cap Fund

A multi cap fund is a type of equity mutual fund mandated by SEBI to invest a minimum of 25% each in large-cap, mid-cap, and small-cap stocks. This ensures the portfolio remains balanced, reducing the risks associated with putting all investments in just one category of companies.

- Large-cap stocks provide stability and steady growth.

- Mid-cap stocks bring expansion potential.

- Small-cap stocks offer higher growth prospects but also higher risk.

By combining these three segments, a multi cap fund creates a balanced portfolio that adapts to different market cycles.

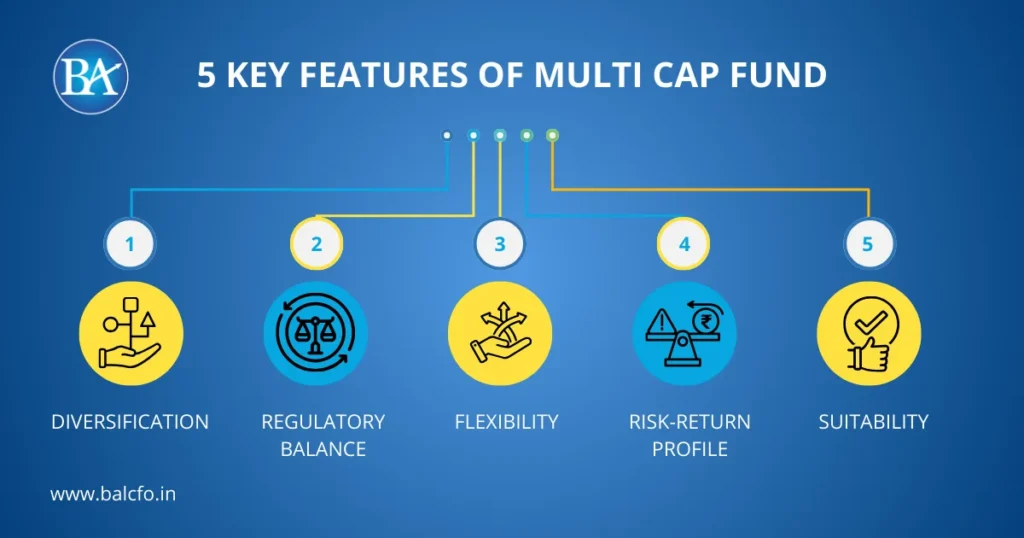

5 Key Features of Multi Cap Fund

When evaluating whether a multi cap fund suits your financial goals, it’s important to understand its main features:

- Diversification: Exposure to companies of all sizes reduces concentration risk.

- Regulatory Balance: At least 75% of the fund’s assets remain in equities, with a mandatory 25% spread across each market cap.

- Flexibility: Fund managers can tactically shift remaining allocations based on market conditions.

- Risk-Return Profile: Offers moderate-to-high risk with a potential for long-term wealth creation.

- Suitability: Ideal for investors with a medium to long-term horizon who want stability, growth, and exposure to emerging opportunities.

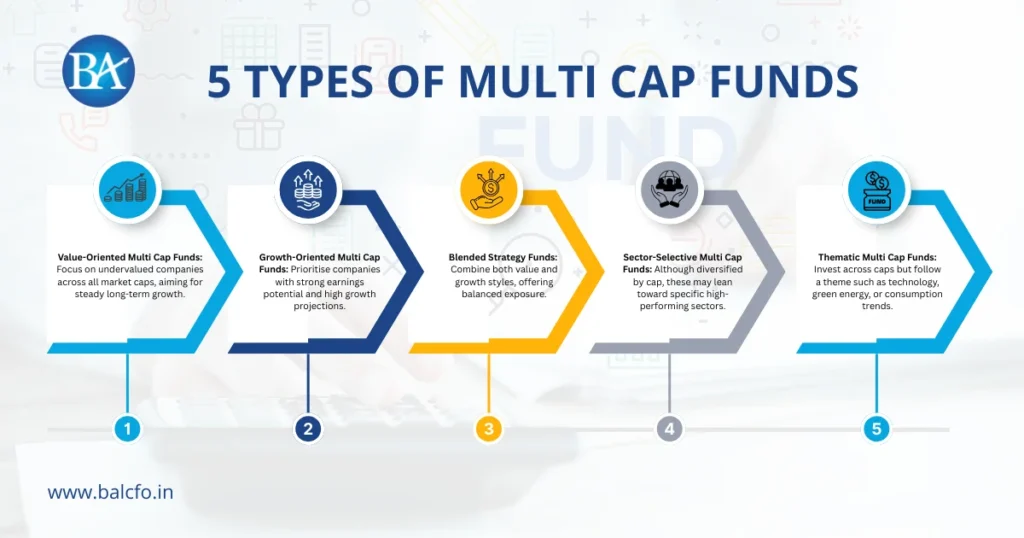

5 Types of Multi Cap Funds

Investors often ask: Are there different types of multi cap funds? While SEBI defines them under a single category, the strategy of each AMC makes them distinct. Here are some broad types of multi cap funds based on approach:

- Value-Oriented Multi Cap Funds: Focus on undervalued companies across all market caps, aiming for steady long-term growth.

- Growth-Oriented Multi Cap Funds: Prioritise companies with strong earnings potential and high growth projections.

- Blended Strategy Funds: Combine both value and growth styles, offering balanced exposure.

- Sector-Selective Multi Cap Funds: Although diversified by cap, these may lean toward specific high-performing sectors.

- Thematic Multi Cap Funds: Invest across caps but follow a theme such as technology, green energy, or consumption trends.

Why Invest in Multi Cap Fund?

Investing in a multi cap fund can benefit individuals who want a “one-stop” equity solution. Instead of investing separately in large-cap, mid-cap, and small-cap funds, a multi cap scheme provides consolidated exposure.

- Reduces decision-making stress: No need to juggle multiple funds.

- Balances risk and return: Diversified allocation lowers volatility.

- Long-term wealth creation: Suitable for investors aiming at goals like retirement, education, or property purchase.

Multi Cap Funds vs Flexi Cap Funds

Many investors confuse multi cap funds with flexi cap funds. The difference lies in allocation rules.

- Multi cap funds: Must allocate at least 25% each to large, mid, and small-cap stocks.

- Flexi cap funds: Fund managers have complete freedom to allocate across market caps without restrictions.

If you want structured diversification, a multi cap is better. If you prefer fund manager flexibility, a flexi cap may work.

Role of Mutual Fund Distributors in Delhi NCR

For first-time and seasoned investors, choosing the right scheme can be overwhelming. This is where professional guidance matters. Mutual fund distributors in Delhi NCR play a crucial role by:

- Helping investors select the right types of multi cap funds suited to their risk appetite.

- Providing insights into taxation, long-term goals, and SIP strategies.

- Offering access to multiple AMCs and portfolio reviews.

BellWether, for example, emphasises research-backed investment strategies, ensuring clients select funds aligned with their financial objectives.

The Final Call

A multi cap fund is a versatile equity investment option for those who seek balanced exposure across company sizes. With features like diversification, mandatory equity allocation, and varied strategies, it offers a well-rounded approach to wealth creation. When combined with expert guidance from mutual fund distributors in Delhi NCR, investors can maximise returns while staying aligned with their risk profile and financial goals.

Why Choose BellWether for Multi Cap Funds?

At BellWether, we understand that every investor’s journey is unique. Our team of experienced advisors and mutual fund distributors in Delhi NCR carefully evaluate the best types of multi cap funds to suit your needs. Whether you’re looking for long-term stability, growth opportunities, or a blend of both, we bring research-driven strategies and a personalised approach to wealth management.

Ready to diversify smartly and build long-term wealth?

Partner with BellWether today and let us guide you in selecting the right multi cap fund for your goals.

FAQs on Multi Cap Funds

1. How is a multi cap fund different from investing in individual large-cap, mid-cap, and small-cap funds?

A multi cap fund brings all three into one portfolio, ensuring regulatory balance and diversification, whereas managing three separate funds requires active rebalancing.

2. Are multi cap funds riskier than large-cap funds?

Yes, because they include mid and small-cap companies which are more volatile. However, diversification helps balance out risks compared to investing only in small-cap funds.

3. Who should invest in a multi cap fund?

These funds are best for investors with a medium to long-term horizon who want growth potential with balanced risk, without the hassle of managing multiple funds.

4. Do multi cap funds offer tax benefits?

They are taxed like other equity funds — long-term capital gains above ₹1 lakh are taxed at 10%, and short-term gains at 15%. No additional tax benefit is specific to multi cap funds.

5. Can I start a SIP in a multi cap fund?

Yes, most fund houses offer SIP options in multi cap funds. This allows investors to build wealth gradually and manage volatility through rupee cost averaging.

6. How do fund managers decide allocation beyond the mandatory 25% rule?

Fund managers analyse market conditions, sectoral opportunities, and company fundamentals before allocating the remaining 25% of the portfolio.

7. Are there international multi cap funds available in India?

Some AMCs launch funds of funds (FoFs) that invest in global equities across market caps, but they fall under a different category. Traditional SEBI-defined multi cap funds focus on Indian equities.