If you’re curious about growth opportunities beyond household blue chips, Small Cap Mutual Funds are where innovation meets higher risk. These funds invest in listed companies with smaller market capitalisations, often agile businesses with room to scale. With that potential comes sharper ups and downs, so the “how they work” really matters.

Table of Contents

ToggleSmall Cap Mutual Funds – Quick Summary for Fast Decisions

- Definition: Small Cap Mutual Funds invest primarily in smaller listed companies with higher growth potential and higher volatility.

- How They Work: Fund managers build diversified baskets of small caps, rotate sectors, and size positions to manage liquidity and risk.

- Who Should Invest: Investors with 7–10 year horizons, higher risk tolerance, and the discipline to stay invested through cycles.

- Ideal Use: Satellite growth bucket alongside core large/multi-cap exposure.

- SIP or Lumpsum: SIP smooths volatility; lumpsum works best after corrections.

- Returns Pattern: Sharp rallies in recoveries; deep drawdowns in risk-off phases.

- Taxation (Equity Funds in India): STCG @ 15% (<12 months); LTCG @ 10% on gains above ₹1 lakh (>12 months).

- Advisor Tip: Work with Mutual fund distributors in Delhi NCR to align allocation with your goals and risk.

What Small Caps are in Simple Terms

Think of the market as a league table by size. The smaller teams (by market value) can sprint—new products, new markets, faster earnings growth. But they can also stumble harder when profits slow or liquidity dries up. Small-cap mutual funds package many such companies into one fund, so a single stock wobble doesn’t sink your entire bet.

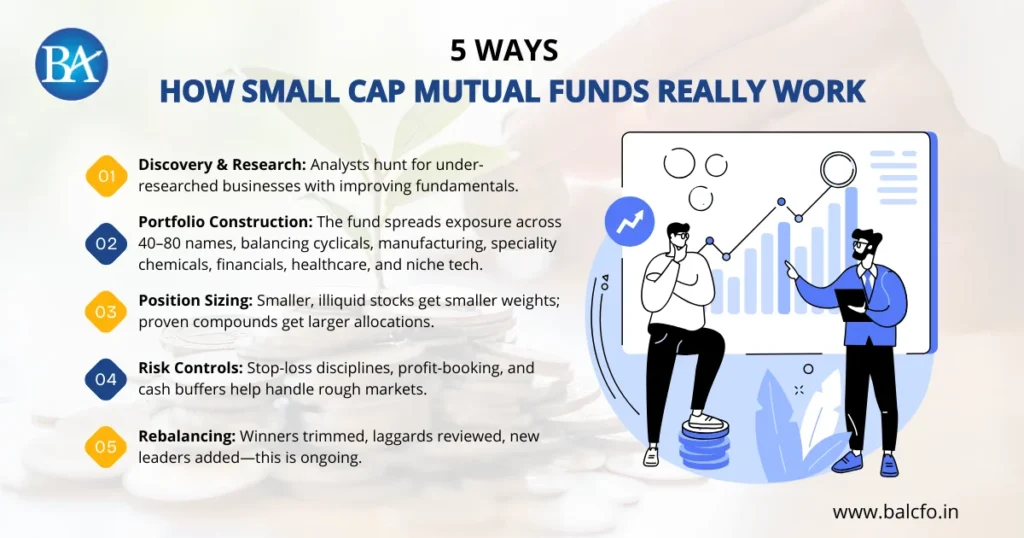

5 Ways How Small Cap Mutual Funds Really Work

- Discovery & Research: Analysts hunt for under-researched businesses with improving fundamentals.

- Portfolio Construction: The fund spreads exposure across 40–80 names, balancing cyclicals, manufacturing, speciality chemicals, financials, healthcare, and niche tech.

- Position Sizing: Smaller, illiquid stocks get smaller weights; proven compounds get larger allocations.

- Risk Controls: Stop-loss disciplines, profit-booking, and cash buffers help handle rough markets.

- Rebalancing: Winners trimmed, laggards reviewed, new leaders added—this is ongoing.

Should You Consider Small Cap Mutual Funds?

Choose Small Cap Mutual Funds if any of these resonate:

- You want a slice of potential multi-baggers and accept volatility.

- Your financial goals are 7+ years away (education, wealth creation, early retirement corpus).

- You already hold a core allocation to type of mutual funds like large-cap or flexi-cap and want a growth kicker.

- You can continue SIPs even when headlines look scary.

Pros, Cons, Reality Check

Pros

- Higher growth runway vs. mature large caps

- Alpha potential from stock-picking and discovery

- SIPs benefit from rupee-cost averaging in drawdowns

Cons

- Deeper, longer drawdowns in market stress

- Liquidity risk, wider bid–ask spreads

- Business execution risk: greater dispersion of outcomes

Reality Check

In euphoric phases, small cap mutual funds can soar; in risk-off, they fall faster. Size your exposure so you can stay invested.

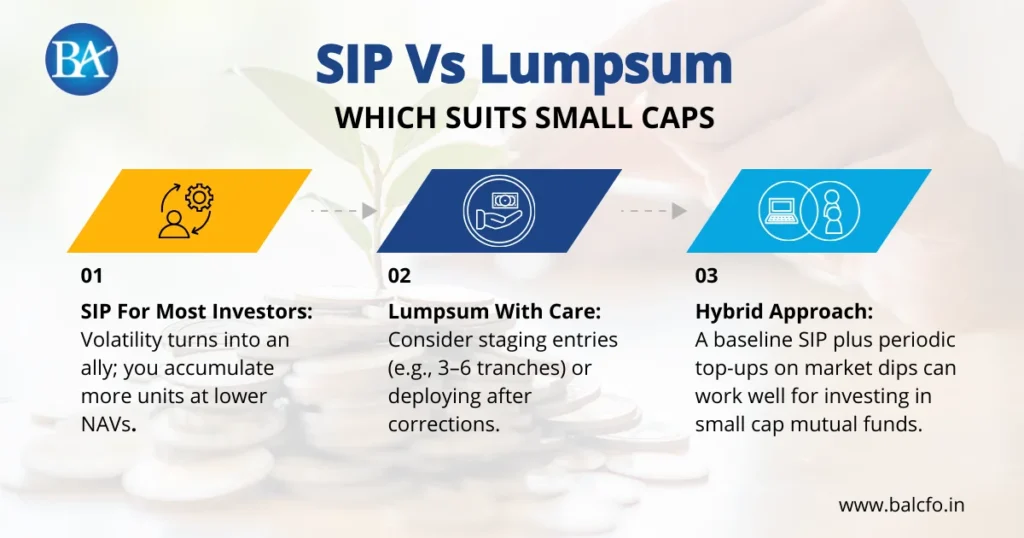

SIP Vs Lumpsum: Which Suits Small Caps

- SIP For Most Investors: Volatility turns into an ally; you accumulate more units at lower NAVs.

- Lumpsum With Care: Consider staging entries (e.g., 3–6 tranches) or deploying after corrections.

- Hybrid Approach: A baseline SIP plus periodic top-ups on market dips can work well for investing in small cap mutual funds.

6 Tips on How to Pick a Small Cap Fund

- Consistency Over One-Off Stars: Look at 5–7 year cycles, not just last year.

- Downside Control: Compare max drawdowns and recovery speeds to peers.

- People & Process: Manager tenure, research depth, portfolio turnover discipline.

- Portfolio Quality: ROCE/ROE trends, cash flows, promoter governance, balance-sheet strength.

- Liquidity Hygiene: No excessive concentration in illiquid microcaps.

- Fit In Your Plan: Use an advisor; SIP distributors in Gurgaon can help calibrate exposure to your risk profile.

How Much to Allocate

A common framework:

- Conservative: 0–10% of equities

- Balanced: 10–20%

- Aggressive: 20–30% (only for seasoned investors)

Start modest, review annually, and rebalance when out-of-range.

Taxation, Costs, Documentation

- Tax (Equity Funds): STCG 15% (<12 months), LTCG 10% above ₹1 lakh gains (>12 months).

- Expense Ratio: Expect higher vs. large caps; research is costlier.

- KYC & Mandates: Complete KYC, set up SIP mandates or UPI autopay for discipline.

Common Mistakes to Avoid

- Chasing last year’s top performer

- Exiting SIPs after drawdowns (missing rebounds)

- Ignoring liquidity and concentration risks

- Over-allocating without a core large-cap anchor

- Skipping a suitability review with Mutual fund distributors in Delhi NCR

Simple Portfolio Use Case

A 60/40 equity/debt investor might place 10–15% of equity in Small Cap Mutual Funds, 35–40% in large/flexi-cap, and the rest in mid-cap/ELSS/international, then rebalance annually.

This keeps the growth kicker without derailing sleep.

BellWether Action Plan

- Map goals and time horizons.

- Assess risk capacity and past behaviour in downturns.

- Decide the allocation band for Small Cap Mutual Funds.

- Choose 1–2 funds with complementary styles.

- Automate SIPs; review once or twice a year—not every headline.

Disclaimer: Investments are subject to market risks. This is educational, not investment advice. Consult an advisor before investing.

Speak With BellWether Team

Want a growth kicker that still fits your life? BellWether’s advisory desk, trusted Mutual fund distributors in Delhi NCR, and seasoned SIP distributors in Gurgaon, will help you size, select, and automate small-cap mutual funds aligned to your goals. Book a quick discovery call and start smarter.

FAQs for Small Cap Mutual Funds

1) Are Small Cap Mutual Funds Good for SIP?

Yes. Volatility helps SIPs accumulate more units at lower NAVs, improving long-run outcomes for investing in small cap mutual funds.ther

2) What Time Horizon Works Best?

Aim for 7–10 years. Small Cap Mutual Funds can have multi-year cycles; patience is a key edge.

3) How Much Should I Allocate as A First-Time Investor?

Start with 5–10% of your equity bucket, review comfort through a cycle, then step up. Use SIP distributors in Gurgaon to design a glide path.

4) Do Small Caps Always Beat Large Caps?

No. They tend to outperform in risk-on expansions and underperform in risk-off or late-cycle slowdowns.

5) What Risks Should I Watch?

Liquidity, earnings execution, governance, and deeper drawdowns vs. large caps. Diversified Small Cap Mutual Funds and disciplined SIPs help manage them.

6) How Do I Choose Between Two Good Funds?

Prefer complementary styles (quality growth vs. cyclicals), check overlap, and compare drawdown control and expense ratios.

7) Can I Do a Lumpsum Now?

Stage entries across months or add larger tranches after corrections. An advisor with Mutual fund distributors in Delhi NCR expertise can time deployments prudently.