For India’s growing base of High Net-Worth Individuals (HNIs), managing wealth isn’t just about investing more; it’s about protecting what you already have. As income grows, so does the tax burden, often eating into wealth that could otherwise be used for future goals, legacy planning, or philanthropic impact.

This is where income splitting enters the picture.

More than just a tax tactic, income splitting is a long-term strategy that allows you to reduce overall taxes legally by redistributing income among family members in lower tax slabs. But here’s the real truth — income splitting isn’t a plug-and-play formula. It’s highly personal, rooted in your family structure, income mix, and life goals.

At BellWether, we’ve seen firsthand how powerful income splitting can be — not just for reducing taxes but for helping families collaborate on wealth building, plan legacy transitions, and ease financial pressures across generations.

Table of Contents

ToggleWhat is Income Splitting? More Than Just a Tax Move

Income splitting, simply put, involves legally transferring income from a higher-taxed individual to someone in a lower tax bracket within the family, so that the total tax paid across the household is minimised. India’s progressive taxation system can lead to real savings if implemented correctly.

Let’s take an example. Suppose you earn ₹1.5 crore annually while your adult daughter, a college student, has no income. If you gift her mutual fund units or dividend-yielding shares, the income generated from those can be taxed in her name. Now, you’ve not only reduced your own tax slab exposure but also empowered her with independent income, giving you more control over your financial situation.

But this isn’t as simple as handing over a cheque. Indian tax laws include several clubbing provisions to prevent tax evasion and misuse. That’s why smart HNIs use thoughtful income splitting strategies, thoroughly documented and supported by legal financial structures such as HUFs, trusts, or partnerships, to feel secure and well-advised in their tax planning.

Why Income Splitting is Crucial for HNIs in 2025

Tax planning in 2025 looks very different than it did a decade ago. Digital audits, real-time reporting, and artificial intelligence-based monitoring systems, such as AIS and TIS, have made scrutiny sharper than ever before.

For HNIs, this means three things:

- There’s little room for casual or undocumented transfers.

- Legacy wealth must be structured across generations with transparency.

- Compliance must be airtight, without compromising tax efficiency.

In this new environment, income splitting offers a legal means to reduce tax burdens while promoting financial inclusion within families. But it requires clarity, customisation, and confidence in your planning partner. When these elements are in place, HNIs can feel reassured and confident in their tax planning strategies.

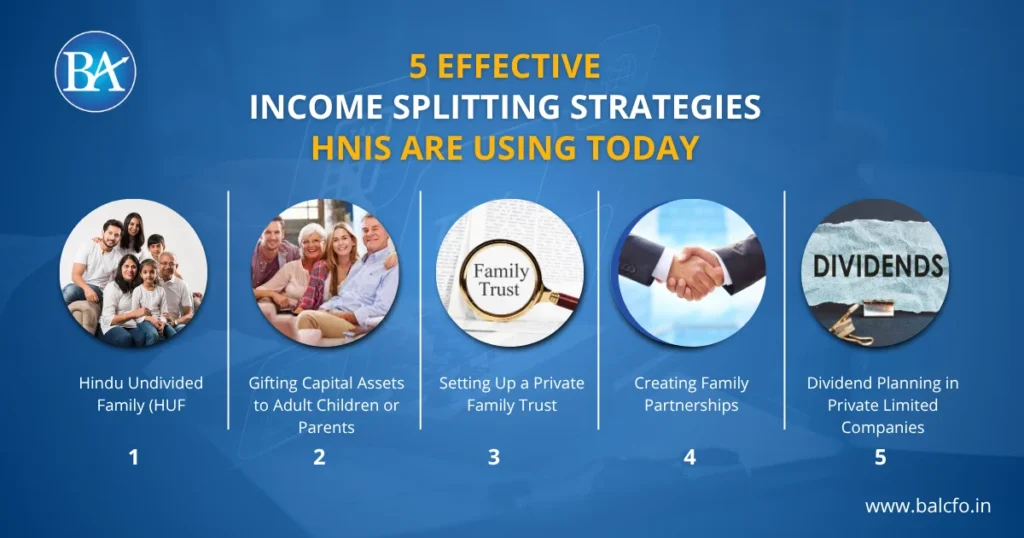

5 Effective Income Splitting Strategies HNIs Are Using Today

There’s no one-size-fits-all when it comes to income splitting. Every HNI’s situation is different, which is why a trusted wealth manager in Gurgaon like BellWether works closely with families to design strategies that are both smart and safe.

Here are some powerful options that are making a real difference in 2025:

1. Hindu Undivided Family (HUF)

Many families overlook the HUF, thinking it’s old-school. However, it remains one of the most reliable tax structures in India. By creating a separate taxable identity, an HUF allows income from ancestral property, businesses, or even gifts to be taxed independently.

With proper documentation, your HUF can invest in mutual funds, earn rental income, and claim deductions, giving your family a financial boost while lowering your tax burden.

2. Gifting Capital Assets to Adult Children or Parents

The law allows you to gift capital assets (like property, shares, or mutual fund units) to adult children or dependent parents. The beauty here is that the income earned from these assets, such as capital gains, dividends, or rent, is taxed in their name, not yours.

This strategy works especially well for HNIs who want to start succession planning early, reduce personal income exposure, or support a non-earning family member.

3. Setting Up a Private Family Trust

Trusts are not just for the ultra-wealthy anymore. More and more Indian HNIs are using family trusts to control how income is distributed, protect wealth from legal disputes, and lower tax obligations.

The trust can be structured to distribute income to beneficiaries in lower tax brackets — such as minor children, elderly relatives, or family members with special needs — while maintaining core control with the trustees.

4. Creating Family Partnerships

Got a business or professional service? You can form a partnership with your spouse, children, or parents, and share profits legally. This works well when family members genuinely contribute capital or effort.

The firm pays a flat tax, but the profits received by partners are not taxed again, making this a smart dual benefit.

5. Dividend Planning in Private Limited Companies

For business owners, shareholding can be assigned strategically within the family to distribute post-tax dividends to those in lower income brackets. With dividends now taxed at the shareholder level, this approach can provide additional savings if structured properly.

All these strategies fall under the larger umbrella of income splitting, but they must be implemented with proper due diligence.

How to Reduce Tax for HNIs: A Step-by-Step Income Splitting Approach

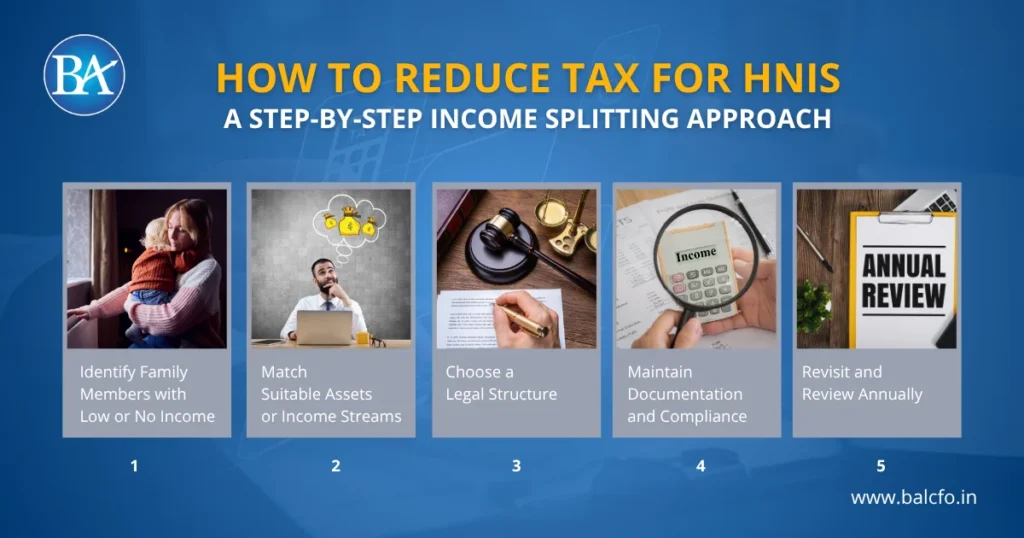

Here’s a roadmap to get started with income splitting effectively:

1. Identify Family Members with Low or No Income

Adult children, non-working spouses, or retired parents are typically eligible. You’ll need to evaluate their current income status, financial goals, and comfort level.

2. Match Suitable Assets or Income Streams

Interest from FDs, dividends, rental income, or long-term capital gains can be restructured or reassigned. The key is choosing income sources that match each member’s financial literacy and risk appetite.

3. Choose a Legal Structure

Decide whether an HUF, trust, gift, or partnership is the best vehicle for you. Each has its advantages and disadvantages, so select carefully.

4. Maintain Documentation and Compliance

This is crucial. Gift deeds, partnership agreements, trust deeds, and separate PANs must be in place. Also, family members must file income tax returns independently to avoid scrutiny.

5. Revisit and Review Annually

Your life changes, and so should your strategy. What works this year may need adjustment next year, based on changes in income levels, goals, or tax regulations.

BellWether’s Expert Approach to Income Splitting for HNIs

Why Choose BellWether: Income Splitting Solutions Designed for You

At BellWether, we don’t offer cookie-cutter tax plans. We offer clarity.

We know HNIs want more than basic savings — they want control, compliance, and continuity. Our team brings decades of experience helping high-net-worth clients confidently navigate Indian tax laws.

Here’s how BellWether can support your income splitting plan:

- In-depth family income audits to identify legal redistribution opportunities

- Custom structuring of HUFs, trusts, and partnerships with clear documentation

- Annual tax planning aligned with evolving income and regulation

- Legal support and audit-proof compliance advisory

- End-to-end wealth management with legacy and succession planning at the core

If you’re wondering how to reduce tax for HNIs and still build wealth meaningfully, income splitting through BellWether is your next smart move.

FAQs on Income Splitting for HNIs – Answered by BellWether

1. What is income splitting, and why is it important for HNIs?

Income splitting is a tax-saving method where income is distributed among family members in lower tax slabs to reduce total tax liability. For HNIs with complex income sources, it’s an essential tool for protecting wealth and planning for the future.

2. How do income splitting strategies differ based on income type?

Different income types, salary, capital gains, rent, dividends, require different structures. For example, dividend income can be shared through private company ownership, while rental income might be better suited to HUFs or gifts.

3. Can minor children be used for income splitting?

Indian law has strict clubbing provisions for minors. However, income earned by minors through manual work, talent, or awards is not clubbed. Most strategies work best with adult children or other adult dependents.

4. Is income splitting allowed under Indian tax law?

Yes, income splitting is legal when done through approved structures and with clear documentation. The Income Tax Act does not prohibit it; instead, it regulates how and when income is taxed based on its source and recipient.

5. Should HNIs consult a wealth manager before implementing income splitting?

Absolutely. Income splitting involves financial, legal, and compliance risks if done incorrectly.