Today, everyone is obsessed with stocks and crypto; the quiet strength of Fixed Income Securities often gets ignored. Yet, these instruments form the bedrock of stable investing.

They provide predictable income, lower volatility, and essential diversification that cushions your portfolio when markets turn rough.

Whether you are saving for retirement, parking funds safely, or balancing risk in a mixed portfolio, knowing how to invest in Fixed Income Securities can make a real difference.

Let us explain what they are, how they work, and what to watch for before you put your money in them.

Table of Contents

ToggleWhat Are Fixed Income Securities?

Fixed Income Securities are investments that pay you a regular, predetermined return, usually in the form of interest.

When you buy one, you are essentially lending money to an entity, a government, company, or institution, in exchange for periodic payments and the return of your principal at maturity.

They include bonds, treasury bills, certificates of deposit, and debentures. These instruments are called “fixed income” because they offer predictable cash flows, unlike equities, where returns depend on price appreciation or dividends.

For anyone working with a Wealth Manager in Delhi NCR, these products often form the stable core of a portfolio that complements higher-risk assets.

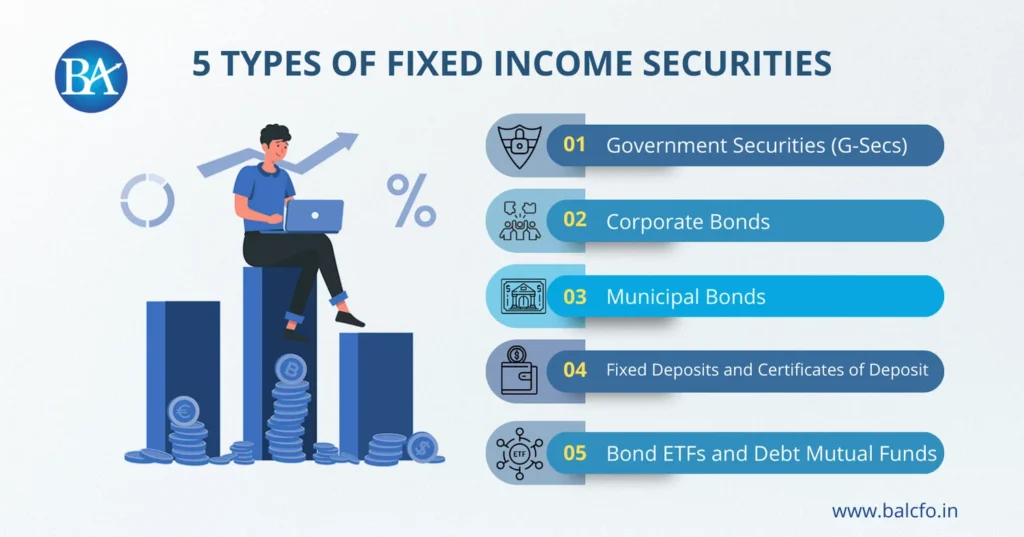

5 Types of Fixed Income Securities

Understanding the main types of Fixed Income Securities helps you decide where they fit in your investment plan.

1. Government Securities (G-Secs)

Issued by the Reserve Bank of India on behalf of the Government, these are the safest instruments in India. They offer semi-annual interest and near-zero default risk.

Examples include Treasury Bills, Government Bonds, and Sovereign Gold Bonds.

2. Corporate Bonds

Issued by companies to raise capital, they typically pay higher interest rates than G-Secs but carry more credit risk. Ratings from agencies like CRISIL or ICRA help assess safety.

3. Municipal Bonds

Issued by local government bodies to fund infrastructure projects such as roads or sanitation systems. They are relatively new in India, but they are growing steadily.

4. Fixed Deposits and Certificates of Deposit

These bank-backed options guarantee returns over a fixed period. They are popular among conservative investors who prefer safety and liquidity.

5. Bond ETFs and Debt Mutual Funds

Modern tools like Bond ETFs (exchange-traded funds) provide exposure to multiple securities in one investment. They are easier to trade and offer better transparency than traditional debt funds.

These types of Fixed Income Securities allow you to match your investments with your time horizon and risk appetite.

4 Reasons Why Investors Choose Fixed Income Securities

1. Stability and Predictable Income – The biggest advantage of Fixed Income Securities is certainty. You know when and how much you will receive, making them perfect for retirees or those needing a steady cash flow.

2. Capital Preservation – They protect your principal value better than equities. When markets decline, fixed income acts as a buffer, maintaining portfolio balance.

3. Diversification – Adding fixed income instruments reduces overall portfolio volatility, a principle every Wealth Manager in Delhi NCR emphasises.

4. Tax Efficiency – Certain bonds and government securities come with tax advantages under specific provisions of the Income Tax Act.

4 Risks You Should Know Before You Invest in Fixed Income Securities

While they are safer than equities, no investment is risk-free. Here are the major risks to understand before you invest in Fixed Income Securities:

1. Interest Rate Risk – When interest rates rise, bond prices fall. The longer the bond’s maturity, the higher the impact. This matters if you plan to sell before maturity.

2. Credit Risk – If a company defaults, you may lose both interest and principal. Always check the credit rating before investing.

3. Inflation Risk – Fixed returns lose purchasing power when inflation rises. Balancing with inflation-protected assets or equities can offset this.

4. Liquidity Risk – Some bonds or deposits are difficult to sell before maturity. Choose instruments with an active secondary market if flexibility is important.

A skilled Wealth Manager in Delhi NCR can help mitigate these risks by choosing diversified instruments and laddered maturities.

How to Invest in Fixed Income Securities

There are several routes to invest in Fixed Income Securities, depending on your comfort level and access to platforms.

- Direct Investment through RBI Retail Direct – lets individuals buy G-Secs directly from the government.

- Through Banks and Brokers – for corporate bonds, FDs, and certificates of deposit.

- Via Bond ETFs and Mutual Funds – for instant diversification with professional management.

- Through Wealth Management Firms – for customised strategies combining bonds, funds, and market-linked debentures.

Each approach has its pros and cons. Direct bonds offer control; funds and ETFs offer simplicity and liquidity.

Who Should Consider Fixed Income Securities

These instruments suit:

- Retirees seeking steady income and capital safety

- Young investors building the defensive part of their portfolios

- Corporates parking short-term cash reserves

- Families working with a Wealth Manager in Delhi NCR to balance growth and protection

Anyone looking to reduce volatility without sacrificing returns can benefit from allocating a portion to Fixed Income Securities.

4 Best Practices Before You Invest in Fixed Income Securities

- Understand Tenure and Yield: Longer maturity typically means a higher yield, but also greater sensitivity to interest rates.

- Check Credit Ratings: Prefer AAA-rated or government-backed securities for lower risk.

- Match Investments to Goals: Align maturity dates with your cash flow needs.

- Diversify Across Types: Use a mix of short-term and long-term instruments from different issuers.

A thoughtful Wealth Manager in Delhi NCR can help create a laddered portfolio that ensures regular income while managing reinvestment risk.

The Foundation of a Balanced Portfolio

Fixed Income Securities may not grab headlines, but they are the unsung heroes of wealth preservation.

They steady the portfolio when markets panic and deliver reliable returns when optimism fades.

A smart investor knows that the road to financial freedom is not about chasing highs, but balancing stability and growth.

Knowing how to invest in Fixed Income Securities can help you achieve that balance confidently.

Balance Your Portfolio with BellWether – Your Personal CFO

If you want to structure a balanced, income-generating portfolio with the right types of Fixed Income Securities, connect with a BellWether Wealth Manager in Delhi NCR.

Our advisors will help you analyse your goals, time horizon, and tax needs before recommending instruments that fit perfectly into your financial plan.

FAQs About Fixed Income Securities

1. Are Fixed Income Securities Completely Risk-Free?

No. They are safer than stocks but still subject to credit, interest rate, and inflation risks.

2. What Are the Most Common Types of Fixed Income Securities?

Government Bonds, Corporate Bonds, Fixed Deposits, and Bond ETFs are the most popular.

3. How Can I Invest in Fixed Income Securities Online?

You can use the RBI Retail Direct platform, brokerage accounts, or consult a Wealth Manager in Delhi NCR for curated options.

4. Are They Suitable for SIP Investors?

Yes. Many mutual funds and Bond ETFs allow systematic investments that mimic SIPs for debt allocation.

5. What Tax Rules Apply to Fixed Income Securities?

Interest is taxable as per your slab. Capital gains from selling bonds are taxed based on the holding period and indexation rules.