The five financial decisions that change outcomes are simple: 1. Build a three to six-month emergency fund, 2. Clear high-interest debt fast, 3. Insure the big risks, 4. Invest every month with a plan, and 5. Map retirement early with a realistic asset mix.

Do these in order, review once a quarter, and your money system will hold up when life gets busy.

Table of Contents

ToggleWhy Smart Financial Decisions Matter More Than Ever In 2025

The everyday investor has more products than time, which is why financial decisions must be clear and repeatable. You do not need perfect timing; you need a process that survives hectic weeks and market noise. When you line up your cash buffer, your debt plan, your risk cover, your monthly investing routine, and your retirement map, stress falls and progress compounds.

This blog turns broad ideas into steps you can actually follow.

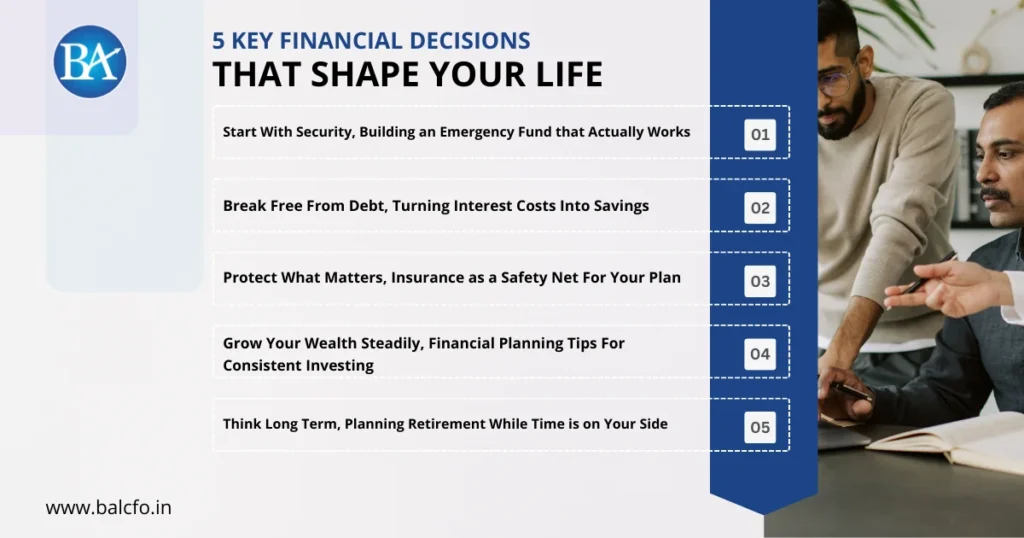

5 Key Financial Decisions That Shape Your Life

The choices you make with money today decide the security, freedom, and opportunities you’ll have tomorrow. From protecting your basics to planning for the future, these five decisions create the foundation of a strong financial life and keep you on track through every stage.

1. Start With Security, Building an Emergency Fund that Actually Works

Your emergency fund is the quiet hero behind every good choice. Without it, a surprise expense can force you to sell investments at the worst time, which breaks even the smartest financial decisions.

What to do now:

- Calculate bare minimum monthly living costs, rent or EMI, groceries, utilities, transport, school, and medical basics.

- Set a target of three months if income is steady, six months if variable or if you have dependents

- Park the money where it is safe and accessible, a high liquidity account or a liquid fund, keep it separate from daily spending.

A good emergency fund makes the rest of your plan easier. You sleep better, you say no to bad offers, and you stop reacting to every headline. This is the first win, and it powers all the other financial decisions that follow.

2. Break Free From Debt, Turning Interest Costs Into Savings

High-interest debt eats future choices. Pay it down quickly, and you will feel the relief in your cash flow and your head. This step multiplies the impact of all other financial decisions.

A simple three-step debt plan:

- List every loan with balance, rate, and EMI, then sort by highest rate first.

- Attack the top loan with every surplus rupee while paying minimums on the rest. When it clears, roll that payment to the next loan.

- Renegotiate or consolidate where possible, and avoid new consumer debt while you are in payoff mode.

When your expensive balances shrink, your guaranteed return rises, because every rupee of interest avoided is a rupee earned. Clearing debt is not just protection; it is growth by subtraction, and it frees cash for smarter financial planning tips later in this guide.

3. Protect What Matters, Insurance as a Safety Net For Your Plan

One medical event or an untimely loss can undo years of effort. Strong risk cover keeps your family secure and keeps your investments intact, which is why this sits ahead of growth choices in the ladder of financial decisions.

Cover the big three:

- Term life, enough to replace income and finish major goals

- Health insurance protects against hospitalisation costs that can drain savings.

- Disability or critical illness riders, where appropriate, especially for single-income families

Insurance is not about chasing the cheapest premium; it is about buying the right promise and reading the fine print. When your risk cover is in place, the rest of your financial decisions can compound without fear of a single event wiping you out.

4. Grow Your Wealth Steadily, Financial Planning Tips For Consistent Investing

Markets reward discipline more than brilliance. A small automated investment repeated on schedule usually beats a large, irregular one. This is where financial planning tips meet real-life habits.

Turn discipline into money:

- Automate a monthly amount into diversified, low-cost vehicles that match your risk profile.

- Keep a simple core, broad market exposure first, and add any satellite positions only after six months of perfect consistency.

- Reinvest windfalls and step up contributions when income rises, use a percentage so growth scales with you.

Stay patient, measure what you can control: savings rate, time in the market, and costs. These levers are boring, which is exactly why they work. Consistent investing is the engine behind your other financial decisions.

5. Think Long Term, Planning Retirement While Time is on Your Side

Retirement planning is the promise you keep to your future self. The earlier you map it, the less you need to save each month. A clear plan also stops you from taking risks that do not match your horizon, which is the silent killer of many financial decisions.

Make retirement real:

- Estimate the monthly income needed in today’s rupees, then inflate it to the year you plan to retire.

- Choose an asset mix you can live with through rough patches, more equity for distant goals, and more fixed income as the finish line nears

- Rebalance annually so your risk stays inside the lane you chose, sell a little of what grew, and add to what lagged

A retirement map turns a vague someday into a clear number and date. It helps you say yes to choices that align with your plan and no to distractions that do not.

India Context You Should Know Before You Act

Your choices live inside rules and realities, and good financial decisions respect that. Understand your tax slabs, the treatment of different asset categories, and the effect of time horizons on risk. Keep an eye on costs, expense ratios, transaction charges, and taxes on gains.

Use reliable platforms, maintain updated KYC, and keep records tidy so execution is never blocked by paperwork.

If you are in a major metro, consider professional help that understands local regulations and products, especially if you are evaluating wealth management services in Delhi NCR for family needs or business owners. The right partner can turn intent into a working system.

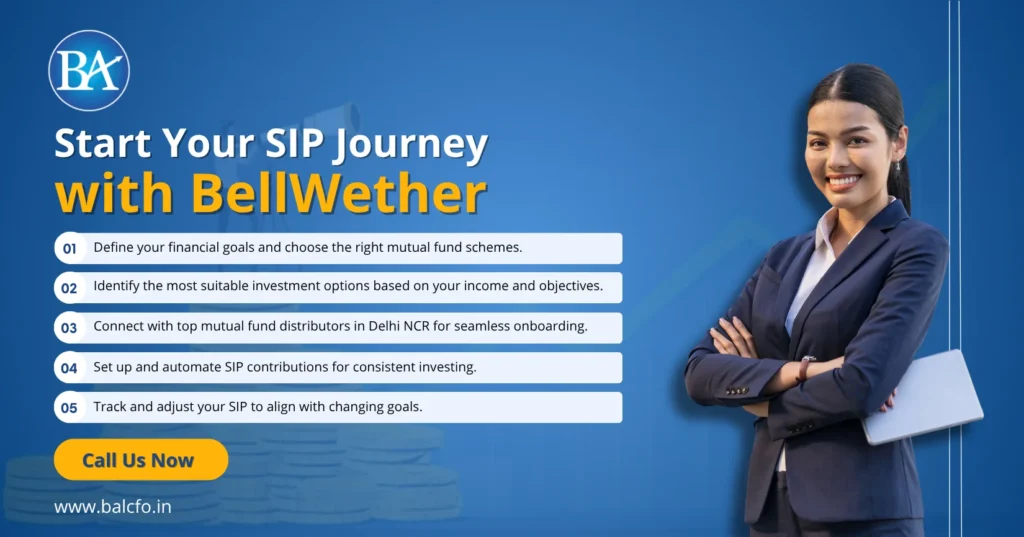

Smart Financial Decisions With BellWether, How We Guide You

BellWether works like a personal CFO, which means your plan is built around your life, not around products. First, we map goals, cash flows, and risk comfort. Next, we fix the foundation, cash buffer, debt plan, and risk cover. Then we design a simple, diversified investment core that you can maintain through market cycles.

Finally, we set a review routine and a rebalancing rule so small course corrections keep you on track. If you prefer a partner, our team can help you navigate platforms, paperwork, and reporting, and if you are exploring wealth management services in Delhi NCR, we can align family, business, and legacy needs into a single view.

BellWether Can Help with Financial Decisions, Four Ways to Act Today

Make your choice simple and disciplined, then keep going.

- Map your goals and risks so product choices fit real-life needs.

- Compare total costs and taxes before you commit, and keep a simple core.

- Automate monthly investing, add clear rules for raises and windfalls.

- Review quarterly, rebalance annually, and update nominees and records.

Book a focused clarity session at balcfo.in and turn intent into a working plan this month.

FAQs on Financial Decisions

1. What are the first financial decisions I should take if I am starting from zero?

Start with an emergency fund so you do not sell investments in a crisis, then create a debt payoff plan for high-interest balances, put basic term and health cover in place, and begin a small monthly investment that you can grow over time. This order reduces risk quickly and builds momentum.

2. Which financial decisions give the fastest visible impact on my cash flow?

Eliminating expensive debt usually shows results within a few billing cycles, because interest costs fall and free cash rises. Pair that with a realistic budget and a separate emergency fund, and the pressure reduces further. You are then ready to increase monthly investing without stress.

3. How do I choose products when I am overwhelmed by options and opinions?

Write down your goal, horizon, and risk comfort first. Filter products that do not match these three. Prefer low-cost, diversified, and transparent choices for core holdings. Keep experimentation small until you have six months of perfect consistency. Simplicity makes financial decisions easier to maintain.

4. What is a sensible review rhythm so my financial decisions do not drift?

Check progress once a quarter, savings rate, emergency fund months, debt outstanding, insurance status, portfolio value, and whether you rebalanced. The annual rebalance resets your risk. A short, regular review avoids big surprises and keeps you close to the plan.

5. When should I consider professional help instead of doing everything myself?

Seek advice when your time is limited, your family situation is complex, or you need accountability to follow through. A professional who offers clear reporting, a review schedule, and conflict-free guidance can accelerate execution. If you want a local partner, evaluate wealth management services in Delhi NCR and pick the team that explains trade-offs in plain language.