If you have ever wondered how investors generate steady cash flow from the stock market without selling their investments, the answer often lies in dividends. For many long-term investors, this income stream becomes a powerful way to supplement earnings, fund everyday expenses, or reinvest for compounding growth.

Yet despite their popularity, many people still feel confused about the types of dividends, how they work, who pays them, when they are paid, and how to use them responsibly.

This comprehensive guide is designed to simplify the entire concept of dividends, walking you step-by-step through real-world processes, calculations, schedules, tax rules, and strategies so you can confidently incorporate them into your personal wealth plan.

Table of Contents

ToggleWhat Are Dividends?

At its core, dividends represent a portion of a company’s profits paid out to its shareholders as a reward for investing in the business. When a company earns more than it needs for operations, growth expansion, or debt management, it may choose to distribute part of that surplus to its investors.

This payment is a sign of financial stability and management confidence, often associated with mature, well-established companies.

For investors, these earnings provide tangible value beyond stock price appreciation. While market prices may rise and fall daily, regular payments add consistency to returns and create a predictable cash-flow component in the investment journey.

Over multi-year horizons, reinvesting dividends into additional shares can accelerate portfolio growth through compounding, allowing earnings to generate further earnings over time.

How Do Dividends Work?

The process of distributing dividends follows a fixed and transparent structure governed by company decisions and stock-exchange regulations.

First, a company’s board of directors formally announces the payout after reviewing profits and available reserves. This public declaration includes the dividend amount per share and detailed timelines. Next comes the eligibility phase, during which investor records are verified to determine which shareholders are entitled to receive the payment.

Finally, on the payout date, dividend income is credited directly into investors’ registered bank accounts or brokerage wallets.

For example, if an Indian company declares a dividend of ₹8 per share and you hold 500 eligible shares, you would receive ₹4,000 in cash when the payment is released. This system ensures transparency and equal treatment for all shareholders holding stock on the qualification date.

This predictable operational flow is what makes dividends exceptionally attractive for planning monthly or annual income strategies.

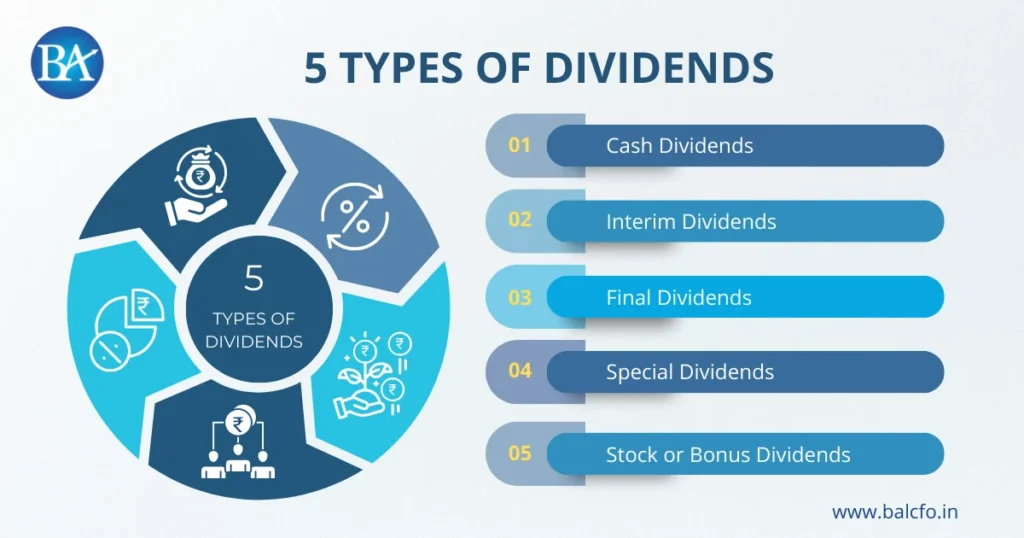

5 Types of Dividends

Companies distribute earnings to shareholders in different ways based on their profit cycles, business expansion plans, and reserve policies. Knowing the types of dividends helps investors identify which payout style fits their financial objectives, whether that goal is immediate cash flow or long-term wealth accumulation.

The most common payout formats include:

1. Cash Dividends

This is the most widely used form of distribution, where dividend income is transferred directly to the investor’s registered bank account. It provides immediate liquidity and is ideal for investors seeking regular income to support household or retirement needs.

2. Interim Dividends

These payments are announced and released before the company concludes its financial year. They usually occur when profit performance during the year is strong, allowing the company to share a portion of earnings without waiting for final accounts.

3. Final Dividends

Declared after annual financial results are approved, final payouts represent the confirmed profit-sharing amount for the year. This is often the larger of the two payments if both interim and final distributions are issued.

4. Special Dividends

These are one-time rewards offered when companies receive exceptional profits, sell major assets, or experience unexpected financial gains. Since they are not recurring, they should not be viewed as part of a regular dividend income plan.

5. Stock or Bonus Dividends

Instead of cash, investors receive additional shares proportionate to their existing holdings. While no immediate income is generated, ownership in the company increases, strengthening long-term growth potential without requiring new investment.

Each payout format serves a different investor need. Cash distributions support regular income planning, interim and final payouts offer structured profit sharing, special rewards enhance occasional gains, and stock payouts boost capital growth. Understanding all types of dividends ensures investors build strategies based on realistic income expectations rather than assumptions.

How Do Dividends Affect a Stock’s Share Price?

When dividends are declared and paid, stock prices respond in logical and predictable ways. On the ex-dividend date, which is the last day to buy shares and qualify for the upcoming payout, the stock price usually drops by a value close to the dividend being distributed. This decrease reflects the fact that company funds reserved for payout are no longer part of business assets.

For example, if a stock trades at ₹500 and announces a dividend of ₹10 per share, the price may adjust to approximately ₹490 once eligibility passes. This shift does not represent a loss to investors who qualified for the payout, as the cash received offsets the price dip.

Long-term investors tend to ignore these short-term movements. The real benefit comes from consistent ownership of strong companies that reliably reward shareholders with payments year after year.

Calculation of Dividends

Learning how to calculate income ensures investors make accurate comparisons between opportunities offering dividends.

Two popular metrics guide decision-making:

1. Dividend Yield:

This measure reflects annual payout as a percentage of the stock price.

Dividend Yield = (Annual Dividend Per Share ÷ Market Price Per Share) × 100

A stock trading at ₹400 that pays ₹8 annually offers a 2% yield.

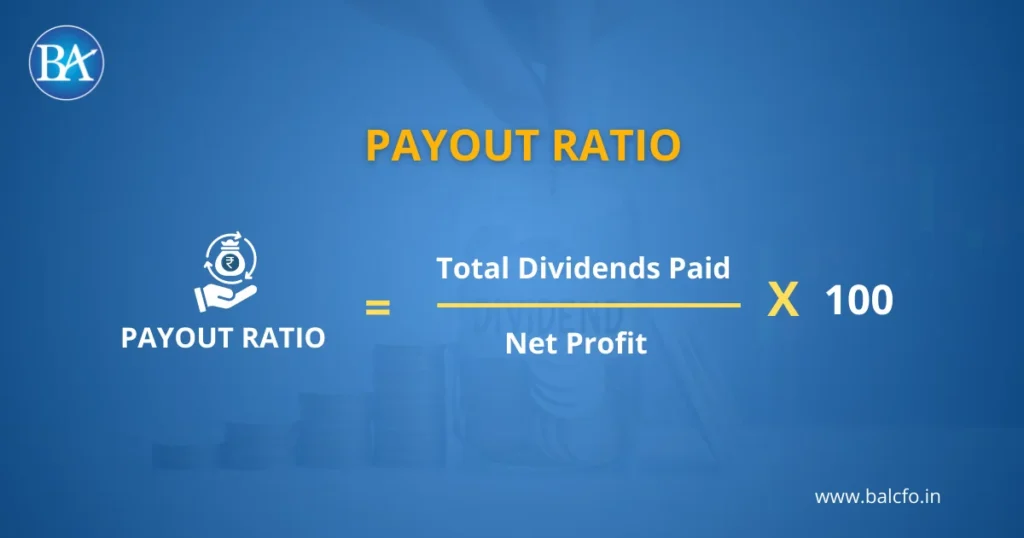

2. Payout Ratio:

This shows the percentage of total company profit returned to shareholders and helps evaluate whether payouts appear sustainable.

Payout Ratio = (Total Dividends Paid ÷ Net Profit) × 100

Very high payout ratios could mean less reinvestment for future growth, whereas balanced ratios reflect stable planning.

These calculations help investors choose sustainable income streams rather than chasing unusually high yields that may not be reliable.

How Are Dividend Amounts Determined?

Companies use several financial factors to decide whether to issue dividends and how much to distribute.

Key considerations include:

- Profitability trends over the past financial years

- Expansion and capital-expenditure requirements

- Debt obligations and cash-flow stability

- Shareholder return objectives set by management

- Economic conditions and market volatility

A business reinvesting heavily for growth may keep payouts low or skip them altogether, even while profits rise. Meanwhile, mature businesses with stable earnings often maintain steady payout schedules, offering dependable income to long-term investors.

Role of Mutual Fund Distributors in Dividend Planning

For investors who lack time, expertise, or confidence to manage portfolios directly, Mutual Fund Distributors play an essential advisory role. They assess short-term income goals, risk capacity, and tax exposure before recommending fund structures tailored to income generation.

Professional advisors assist clients in selecting balanced or income-oriented mutual fund schemes, monitoring payout sustainability, and rebalancing exposure as personal financial needs evolve. Ongoing support from Mutual Fund Distributors also ensures compliance with changing tax regulations and helps maintain realistic return expectations.

Partner with BellWether for Dividend Planning

At BellWether, a trusted Wealth Management Company in India, our experts design personalized dividend strategies aligned to your income needs and financial goals.

We help turn investment decisions into stable, tax-efficient income pathways for long-term security.

- Customized dividend planning based on your lifestyle and retirement goals

- Tax-efficient portfolio structuring aligned with 2025 regulations

- Balanced income and growth strategies for sustainable wealth creation

- Ongoing portfolio reviews and professional guidance for consistent results

FAQs About Dividends

1. Can beginners safely start investing for dividend payouts?

Yes, beginners can start small by choosing diversified funds or blue-chip stocks with consistent payout records and gradually expanding exposure as confidence grows.

2. Are monthly income streams possible from dividends?

Monthly payouts aren’t typical from individual companies, but combining payouts from multiple stocks or funds across schedules can simulate monthly cash flow.

3. Should young investors focus on dividend plans?

Young investors often benefit more from reinvestment approaches, allowing early compounding to boost long-term wealth even when income needs are low.

4. Are dividend payments guaranteed every year?

No payouts are guaranteed. They depend on company profits and board decisions, meaning economic downturns can result in reductions or suspensions.

5. What happens to dividends if I sell shares early?

If the shares are sold before the ex-dividend date, the seller forfeits eligibility, while the buyer becomes entitled to the upcoming payment.