When markets get choppy and interest rates rise or fall unpredictably, investors look for something steady, something that offers safety without locking up liquidity.

That is where Bond ETFs come in.

Unlike traditional bonds or fixed deposits, Bond ETFs combine the stability of fixed income with the flexibility of equities.

They are transparent, low-cost, and make investing in Bond ETFs far simpler for everyday investors.

Before you invest, let us understand how they work, what makes them different, and when they fit best in your portfolio.

Table of Contents

ToggleWhat Are Bond ETFs?

A Bond ETF (Exchange Traded Fund) is a basket of bonds, such as government, corporate, or a mix of both, that trades on the stock exchange like a share.

Instead of buying individual bonds with varying maturities, you buy units of a fund that holds a diversified bond portfolio.

This single product gives you exposure to dozens of issuers and maturities.

You do not need to track coupons or maturities manually because the fund’s structure handles that for you.

Example:

- The Bharat Bond ETF invests in AAA-rated public sector bonds.

- The ICICI Prudential Corporate Bond ETF invests in high-quality corporate issuers.

Both offer diversification, predictable returns, and liquidity, making Bond ETFs an important part of any balanced portfolio.

How Do Bond ETFs Work?

When you buy a Bond ETF, your money goes into a pooled fund that holds multiple fixed-income securities.

The fund’s Net Asset Value (NAV) changes with:

- Interest rate movements

- Bond market prices

- Maturity schedules and coupon payments

Unlike a fixed deposit, Bond ETFs do not guarantee capital protection, but they do offer continuous liquidity since you can trade them during market hours.

This is why many investors use Bond ETFs as part of their short-term liquidity or low-volatility strategies. These are often advised by a Wealth Management Solution in Delhi NCR focused on balancing income and access.

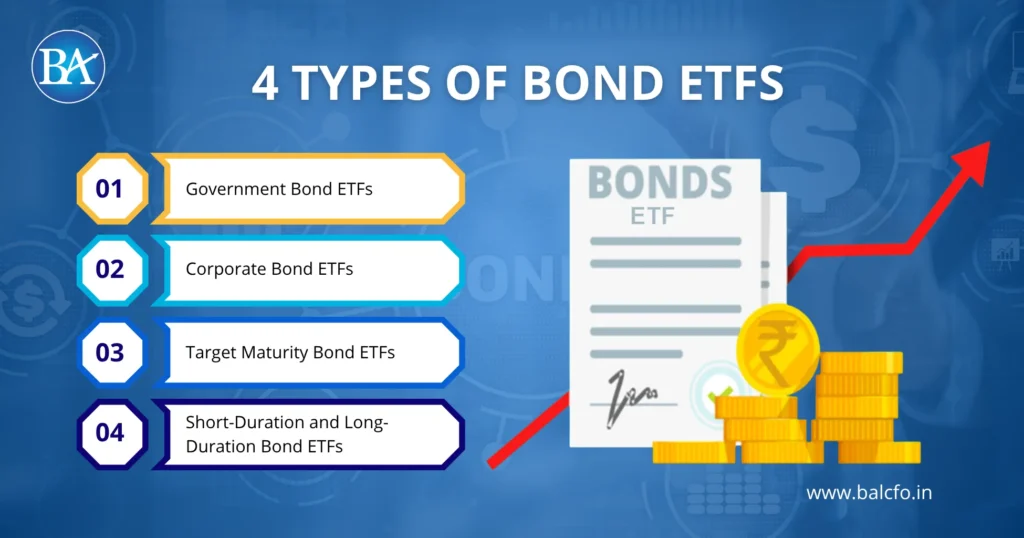

4 Types of Bond ETFs

“Bond ETF” is a broad term that covers several categories designed for different goals.

- Government Bond ETFs

These invest in sovereign securities, which carry the least default risk.

Ideal for conservative investors who prioritise safety and steady returns. - Corporate Bond ETFs

These hold high-rated company bonds. They generally yield more than government ETFs but come with slightly higher credit risk. - Target Maturity Bond ETFs

These funds have a fixed maturity date. You receive principal and accrued interest at the end, giving them a predictable structure similar to a bond ladder. - Short-Duration and Long-Duration Bond ETFs

Short-duration funds react less to interest rate changes. Long-duration ones carry higher rate sensitivity but can deliver bigger gains when rates fall.

Understanding these types helps investors make smarter decisions while investing in Bond ETFs that match their goals and time horizon.

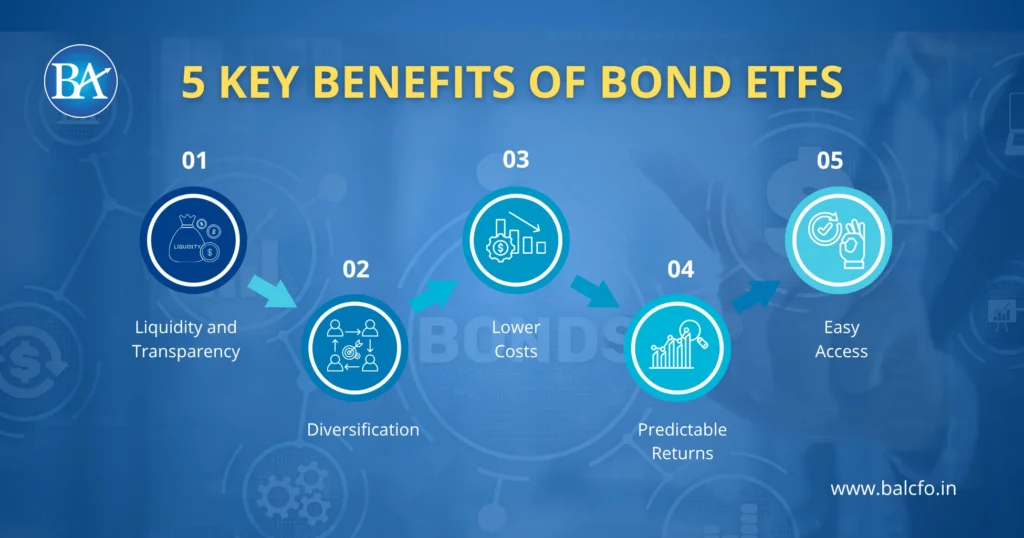

5 Key Benefits of Bond ETFs

1. Liquidity and Transparency

You can buy or sell Bond ETFs at any time through the exchange. Prices are visible in real time, which eliminates the need for intermediaries.

2. Diversification

Each ETF spreads your investment across many issuers, maturities, and sectors. This diversification reduces the impact of a single bond default.

3. Lower Costs

Unlike debt mutual funds, Bond ETFs usually have lower expense ratios. You pay only standard brokerage and nominal management fees.

4. Predictable Returns

While they may fluctuate, the overall yield curve of a Bond ETF is more stable compared to equity instruments. That predictability is one of the strongest benefits of Bond ETFs.

5. Easy Access

You can invest using any demat account or online broker. Most Wealth Management Solutions in Delhi NCR recommend them to clients seeking reliable fixed-income exposure with simple tracking.

4 Risks and Considerations Regarding Bonds ETFs

Even the safest asset class carries risk. Bond ETFs are not exceptions.

1. Interest Rate Risk

When interest rates rise, bond prices fall. Selling your ETF before maturity during such a phase can result in small losses.

2. Credit Risk

Corporate Bond ETFs can face risk if issuers default. Government ETFs avoid this but trade at lower yields.

3. Tracking Error

Small mismatches between the ETF and its benchmark index can occur due to expenses or timing differences.

4. Liquidity Risk

Some niche or low-volume ETFs may not trade actively. Choose ETFs with high daily turnover for smoother entry and exit.

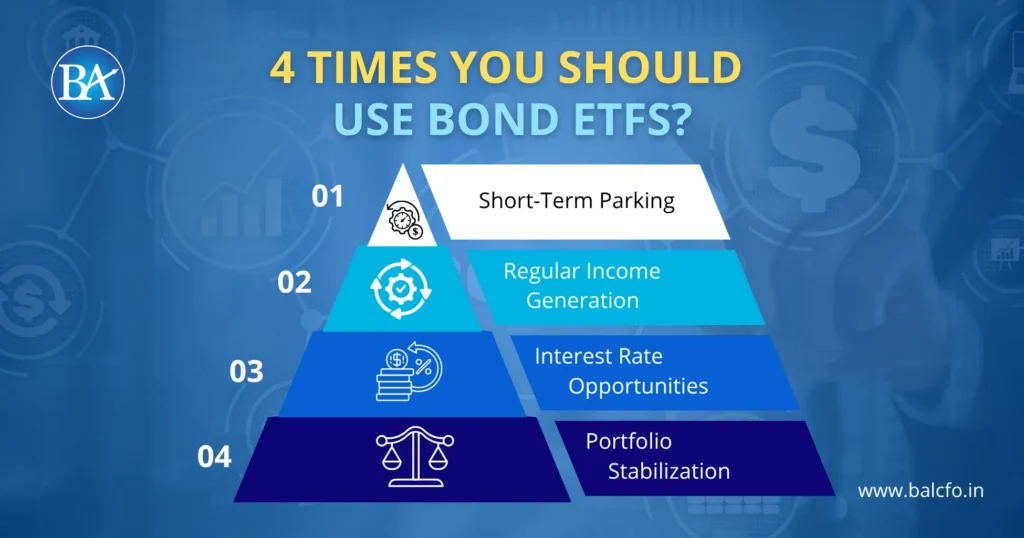

4 Times You Should Use Bond ETFs?

Timing depends on your goals, but Bond ETFs are best used in these scenarios:

- Short-Term Parking

A safe space for funds you might need within one to two years. - Regular Income Generation

Target Maturity Bond ETFs provide predictable income streams with better tax efficiency than fixed deposits. - Interest Rate Opportunities

When rates peak, locking into long-duration Bond ETFs helps capture higher yields for the long run. - Portfolio Stabilization

They reduce equity volatility in long-term portfolios. Most Wealth Management Solutions in Delhi NCR use them for balance and risk control.

Bond ETFs vs Debt Mutual Funds

| Feature | Bond ETFs | Debt Mutual Funds |

|---|---|---|

| Liquidity | Traded on exchanges | Redeemed through AMC |

| Expense Ratio | Lower | Slightly higher |

| Transparency | Real-time pricing | End-of-day NAV |

| Exit Load | None | May apply |

| Taxation | Identical | Identical |

Both have their uses, but Bond ETFs stand out for investors who prefer direct market access and cost efficiency.

Taxation Rules for Bond ETFs

Bond ETFs are taxed as debt instruments:

- Short-Term Gains (less than 3 years): Taxed as per your income slab.

- Long-Term Gains (3 years or more): Taxed at 20% with indexation benefits.

If you use Bond ETFs within a retirement or income portfolio, coordinate the structure with your Wealth Management Solution in Delhi NCR for optimal post-tax efficiency.

The Smart Middle Ground

Bond ETFs bridge the gap between conservative and aggressive investing.

They offer diversification, transparency, and control without the need to track dozens of individual bonds.

Whether you want stability or regular income, investing in Bond ETFs adds balance and confidence to your portfolio.

Align Your Wealth Goals with BellWether – Your Personal CFO

If you want to know which Bond ETFs align best with your goals, speak to a BellWether Wealth Management Solution in Delhi NCR.

Our experts can help you design a portfolio that earns steady returns while keeping liquidity and safety intact.

FAQs About Bond ETFs

1. Are Bond ETFs Safe?

They are relatively safe, especially government ETFs, but still carry market and rate risk.

2. How Are Bond ETFs Different from Direct Bonds?

Buying one bond means lending to one entity. A Bond ETF invests across many, giving you diversification and better liquidity.

3. Can I Do SIPs in Bond ETFs?

Yes. Platforms now support systematic investing in Bond ETFs for steady accumulation.

4. What Is the Ideal Tenure for Bond ETFs?

Match it to your goals. Three to five years for short-term stability, seven years or more for wealth preservation.

5. What Are the Key Benefits of Bond ETFs Over FDs?

Better tax treatment, higher liquidity, and more flexibility. These benefits of Bond ETFs make them a smart alternative for today’s investors.