In late 2025, the Securities and Exchange Board of India (SEBI) made a regulatory move that few retail investors noticed, but every high-net-worth individual should pay attention to. Mutual funds are now barred from participating in pre-IPO placements, cutting off a once-lucrative channel for early-stage exposure.

For years, select fund houses used pre IPO investing to secure allocations in companies before they went public, a strategy that helped boost returns in strong markets. SEBI’s latest circular changes that landscape completely.

Let’s understand what the rule means, why it matters, and how HNI investors can recalibrate their equity strategies in response.

Table of Contents

ToggleWhat SEBI’s New Regulation Says

According to SEBI’s 2025 circular, mutual funds can no longer invest in companies during their pre-IPO placement stage. The restriction applies to both equity and hybrid schemes.

The reasoning:

- To prevent conflicts of interest between fund managers and issuers

- To ensure a level playing field among investors

- To maintain transparency in fund operations

Earlier, fund managers could negotiate allocations in the private placement round right before the IPO. This often provided access to discounted valuations that public investors couldn’t match.

With the ban, SEBI has effectively closed the door on this practice, marking one of the most significant mutual fund investment restrictions in recent years.

Why SEBI Took This Step

The regulator acted to curb preferential allotments and insider advantages. This ensures mutual fund valuations reflect genuine market forces.

- Preferential Allotments Before Listing: Some funds secured large allocations in upcoming IPOs through negotiated deals.

- Price Influence: These early placements often affected how companies priced their IPOs.

- Perception of Insider Advantage: The optics of fund managers accessing pre-listing deals raised fairness concerns.

By eliminating pre-IPO access for mutual funds, SEBI aims to make capital markets cleaner, fairer, and less vulnerable to valuation manipulation.

What This Means for Pre IPO Investing

For HNIs and family offices, this rule doesn’t ban pre IPO investing, it simply changes who can do it and how.

Mutual funds are now excluded, but alternative investment funds (AIFs), portfolio management services (PMS), and private equity channels remain open.

Key takeaway:

The playing field has narrowed, but it’s not closed. Sophisticated investors who work with a registered wealth management firm in Delhi NCR can still explore early-stage opportunities, just through more regulated, specialized vehicles.

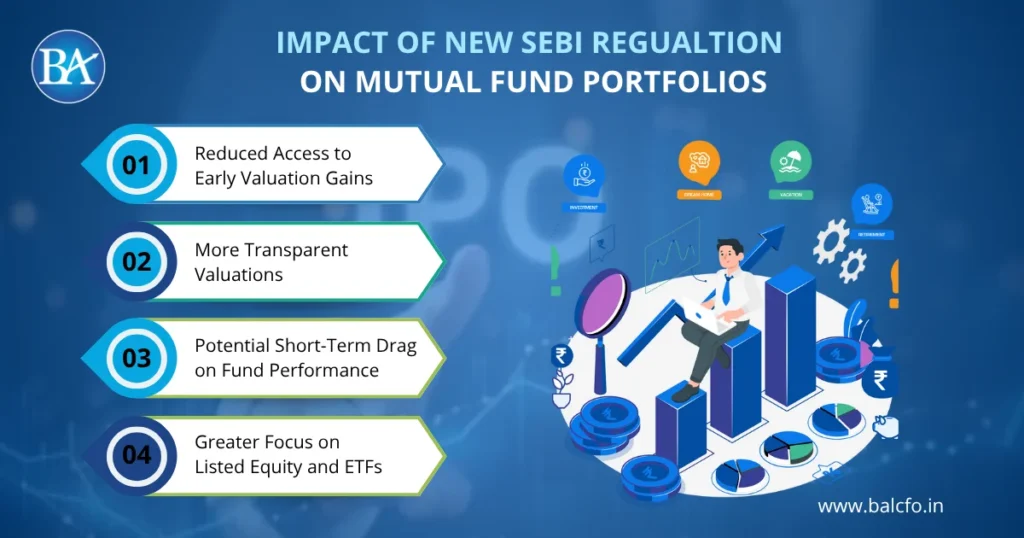

Impact of New SEBI Regulation on Mutual Fund Portfolios

This ban has ripple effects that extend beyond regulatory compliance. It directly influences how mutual funds manage risk, growth, and alpha generation.

- Reduced Access to Early Valuation Gains

Mutual fund investors may no longer benefit from the steep appreciation that often follows IPO listings. - More Transparent Valuations

Funds will now enter positions only after listing, ensuring that pricing reflects real market demand. - Potential Short-Term Drag on Fund Performance

Some actively managed schemes that relied on pre-IPO exposure for alpha may see moderated returns. - Greater Focus on Listed Equity and ETFs

Fund managers may now lean more heavily on mid-cap and thematic funds for growth.

While these shifts may sound restrictive, they also align the industry closer to global standards of transparency and retail fairness.

Why HNI Investors Should Care

If you’re an HNI or ultra-HNI, this regulation indirectly affects your overall wealth strategy.

Pre-IPO allocation used to offer three clear advantages:

- Early Entry: Ability to buy equity before public listing

- Discounted Pricing: Access to shares at lower valuations

- Limited Dilution: Early participation often led to priority allocations

With mutual funds out of the picture, HNIs can no longer rely on indirect exposure through fund houses.

Instead, you’ll need to evaluate pre IPO investing more actively through direct or institutional partnerships.

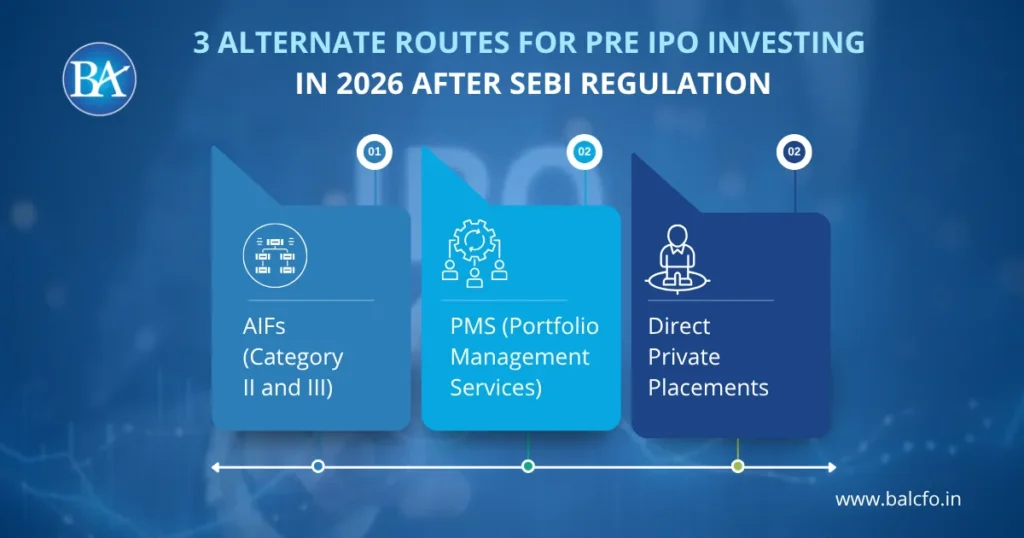

3 Alternate Routes for Pre IPO Investing in 2026 After SEBI Regulation

For investors still interested in early-stage opportunities, here’s what remains available:

1. AIFs (Category II and III)

These funds can participate in unlisted equity with professional management oversight.

Ideal for investors with higher risk tolerance and long-term horizons.

2. PMS (Portfolio Management Services)

Select PMS providers offer hybrid portfolios with a small allocation to late-stage private companies.

It allows exposure to pre-IPO value creation under close regulation.

3. Direct Private Placements

HNIs working with credible advisors can directly invest in pre-IPO deals, provided due diligence, compliance, and exit timelines are well defined.

A wealth management firm in Delhi NCR, like BellWether, helps structure these opportunities responsibly, balancing regulatory safety with growth potential.

What Should Investors Do Now?

This is the time to review, rebalance, and reposition your investments strategically.

- Review Your Mutual Fund Holdings

Check if any of your funds previously participated in pre-IPO allocations. Fund fact sheets or management commentary will highlight this. - Diversify Your Private Market Exposure

Instead of chasing IPO-linked alpha through mutual funds, consider AIFs or PMS vehicles vetted by your advisor. - Rebalance Your Risk Profile

Without pre-IPO gains boosting fund performance, revisit your asset allocation for optimal risk-reward balance. - Consult a Professional Advisor

Regulatory changes often require strategic adjustment. Work with a trusted wealth management firm in Delhi NCR that understands both compliance and opportunity.

Explore Smarter Pre IPO Investing with BellWether- Your Personal CFO

BellWether helps HNI investors access exclusive pre-IPO opportunities with expert due diligence, valuation insights, and risk-balanced strategies.

Work with a leading wealth management firm in Delhi NCR to invest intelligently, compliantly, and profitably.

How BellWether Supports You

- Curated access to late-stage private companies

- Regulatory-safe investment structuring

- Balanced growth with risk control

- Expert wealth managers guiding every step

Consult BellWether today to explore smarter pre IPO investing options designed for HNIs.

FAQs About Pre IPO Investing

1. What is pre IPO investing?

It’s the process of investing in a company’s shares before they go public. Investors gain early access to potential growth but accept higher risk and lower liquidity.

2. Why has SEBI restricted mutual funds from pre-IPO placements?

To improve transparency, reduce preferential treatment, and prevent conflicts of interest in the mutual fund industry.

3. Can HNI investors still invest in pre-IPO companies?

Yes. HNIs can invest directly or through regulated AIFs and PMS structures, though with stricter compliance norms.

4. Does this rule affect all mutual funds?

Yes. The restriction applies across all equity and hybrid schemes that previously accessed pre-IPO rounds.

5. How can investors adapt to this change?

Work with an experienced wealth management firm in Delhi NCR to identify alternate routes for early-stage exposure and rebalance your mutual fund portfolio.