Let’s be honest. For years, investing in India revolved around chasing returns. Buy low, sell high. Choose the top mutual fund. Time the market. Repeat.

However, the landscape has evolved. In 2025, with economic shifts, career flexibility, and evolving life priorities, investors are now asking a more strategic question: “What am I really investing for?” This shift in mindset is crucial in understanding the importance of goal-based investing.

This is where goal-based investing steps in, flipping the script from product-driven investing to purpose-driven wealth planning. It’s not just about growing your money, it’s about aligning your investments with the life you actually want, giving you a sense of control and confidence in your financial future.

Table of Contents

ToggleWhat Is Goal-Based Investing?

At its core, goal-based investment is a strategy where you define specific financial goals — like buying a house, retiring comfortably, or funding your child’s education — and then build tailored investment plans to achieve them.

Instead of randomly allocating funds, you:

- Set clear, time-bound goals

- Calculate how much you need and when

- Choose the right instruments (equity, debt, SIPs, etc.)

- Track and adjust based on progress and market conditions

Goal-based investing is not just about growing your money; it’s about aligning your investments with the life you actually want. It’s structured. It’s intentional. And it puts you at the centre of your wealth strategy, ensuring your money is working towards your specific life goals.

Why It Matters More Than Ever in 2025

Let’s look at the bigger picture.

- India’s inflation rate, though stabilising, still affects long-term purchasing power.

- Life milestones — such as marriage, children, and retirement — are becoming increasingly expensive.

- People now prioritise lifestyle goals: sabbaticals, second homes, and early retirement.

Traditional investing doesn’t account for the emotional and lifestyle dimensions of money. Goal-based investing bridges that gap, offering both peace of mind and better financial outcomes, ensuring you feel secure and at ease about your financial future.

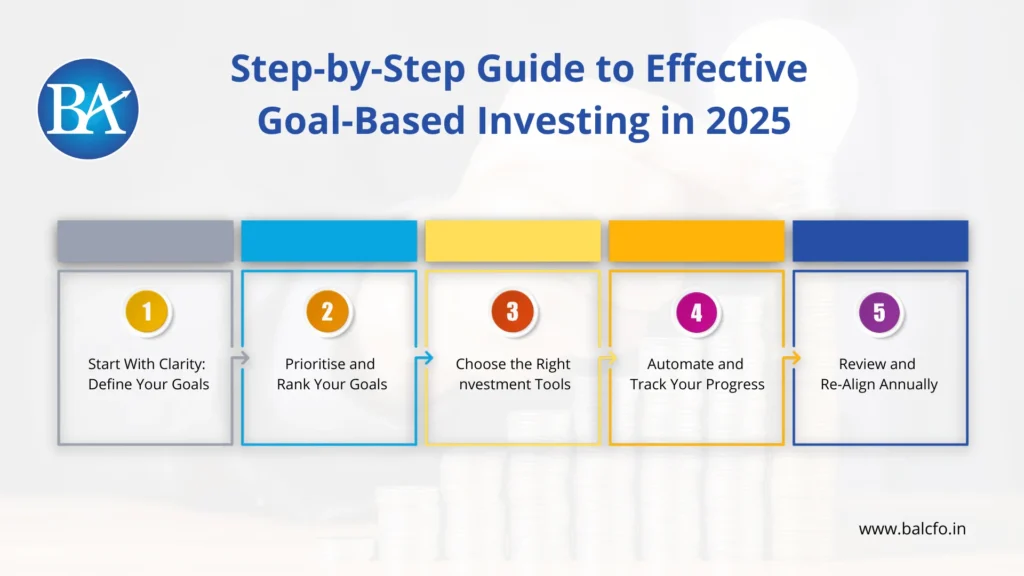

Step-by-Step Guide to Effective Goal-Based Investing in 2025

1. Start With Clarity: Define Your Goals

Not all goals are created equal. To invest smartly, break your goals into categories:

- Short-Term (1–3 years): Emergency fund, travel, gadget upgrades

- Medium-Term (3–7 years): Buying a car, wedding planning, home down payment

- Long-Term (7+ years): Retirement, child’s higher education, wealth creation

Use real numbers. If your goal is to fund your daughter’s MBA abroad in 10 years, estimate the future cost (₹60–80 lakhs including inflation), not just today’s tuition.

2. Prioritise and Rank Your Goals

You can’t fund everything at once. Identify your non-negotiables and nice-to-haves. Assign timelines and urgency. This helps in choosing the right asset allocation and risk exposure for each goal.

Example:

- Retirement – 30 years away – High priority – Equity heavy

- Europe trip – 2 years away – Medium priority – Balanced or debt-oriented

This personalised structure is why goal-based investment works better than generic wealth-building.

3. Choose the Right Investment Tools

Now comes the fun part — putting your money to work. Based on your time horizon and risk profile, you’ll choose from:

- SIPs (Systematic Investment Plans): Ideal for long-term, consistent goal funding. A trusted SIP distributor in Gurgaon, like BellWether, can help structure these across diversified mutual funds.

- Debt Funds & FDs: Great for short-term or capital-protection goals.

- ELSS, PPF, NPS: Good for retirement and tax-saving goals.

- Hybrid or Balanced Funds: For mid-term needs with moderate risk.

Remember, no single product is “best.” It’s about the right fit for the right goal.

4. Automate and Track Your Progress

Once your plans are in place, automation is your best friend. SIPs, STPs, and goal-based investment platforms let you contribute monthly with zero hassle.

Tracking is equally important. Every 6 months:

- Check goal progress vs. expected value

- Adjust SIP amounts if needed.

- Rebalance based on market shifts or life changes (like a salary jump)

At BellWether, we offer tech-enabled dashboards with real-time tracking so you’re never in the dark about your financial goal planning.

5. Review and Re-Align Annually

Life doesn’t go as planned — and that’s okay. A baby on the way, a career shift, or inflation spikes might change your financial landscape.

The beauty of goal-based investment is its flexibility. Reassess your goals annually:

- Do timelines need updating?

- Can you afford to save more?

- Do you need to add new goals?

This proactive mindset ensures your portfolio evolves with you, not against you, making you feel adaptable and prepared for life changes.

What Is the Main Benefit of Goal-Based Investment?

The main benefit of goal-based investment is that it aligns your money with your life goals. It creates a personalised investment strategy based on specific time-bound targets, helping you stay disciplined and reduce the stress of market fluctuations. This approach reduces emotional decisions, provides clarity, and adds structure to your financial journey, regardless of your income level.

Real-World Example: Meet Rohan & Meera

Rohan and Meera, a couple in their mid-30s from Gurgaon, wanted to plan their child’s education, a second home, and early retirement. However, they were unsure about where to begin.

Through BellWether’s goal-based investing approach, we helped them:

- Set clear targets and timelines

- Begin SIPs with increasing amounts over time.

- Balance equity and debt exposure.

- Review and update their goals annually

Today, their money is not just growing, it’s working for their dreams.

Goal-Based Investing vs Traditional Investing

| Feature | Traditional Investing | Goal-Based Investing |

| Focus | Returns | Life Goals |

| Planning | Generic | Personalised |

| Emotional Comfort | Low | High |

| Market Reaction | Reactive | Disciplined |

| Tools | Lump sum, random SIPs | Purpose-led SIPs, automated plans |

Goal-based investing reduces emotional decisions, provides clarity, and adds structure to your financial journey, no matter your income level.

Final Thoughts: Invest with Purpose, Not Pressure

Goal-based investment gives your money meaning. It shifts your focus from chasing the market to creating a roadmap for life. Whether you’re just starting out or rethinking your wealth strategy in 2025, aligning your investments with your personal goals is the most effective way to build long-term, stress-free financial success.

FAQs About Goal-Based Investing

1. Can I start goal-based investing with a small amount?

Absolutely. Even ₹1,000 per month via SIPs is a great start. What matters is consistency and clarity of purpose. As your income grows, you can scale your contributions.

2. What happens if I miss a goal timeline?

Life happens. The key is to reassess your strategy. You can either delay the goal slightly, increase your investment, or adjust your lifestyle expectation. Goal-based investing is flexible, not rigid.

3. Is goal-based investing only for big goals?

Not at all. It works just as well for short-term needs like vacations, gadgets, or emergency funds. It’s about assigning a purpose and timeline to your money, regardless of size.

4. Do I need a financial advisor for goal-based investment?

While you can start solo, working with an advisor or a professional SIP distributor in Gurgaon like BellWether gives you access to tailored advice, tax planning, and portfolio management— all of which boost success rates.

5. How do I know if I’m on track to meet my goals?

Use online calculators or advisor dashboards to compare your current investments against the future cost of your goal. Tracking your investment growth every six months will help you stay on target or make timely adjustments.